Innovations in Barrier Properties

Innovations in barrier properties are significantly influencing the Bopet Packaging Films Market. Enhanced barrier films are being developed to provide superior protection against moisture, oxygen, and light, which are critical factors in preserving product integrity. These advancements are particularly relevant in sectors such as food and pharmaceuticals, where product shelf life is paramount. The introduction of multi-layered Bopet films with advanced barrier technologies is expected to capture a larger market share, potentially increasing the industry's value by an estimated 6% annually. This focus on improved barrier properties reflects the industry's commitment to meeting stringent quality standards and consumer expectations.

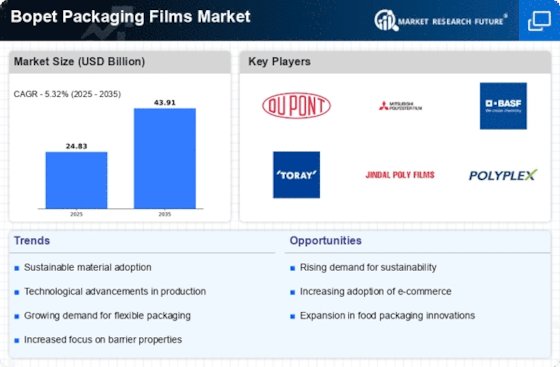

Rising Demand for Flexible Packaging

The Bopet Packaging Films Market is experiencing a notable increase in demand for flexible packaging solutions. This trend is largely driven by the growing consumer preference for lightweight and easy-to-handle packaging options. Flexible packaging not only enhances product shelf life but also reduces material waste, aligning with sustainability goals. According to recent data, the flexible packaging segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is indicative of a broader shift towards more adaptable packaging solutions that cater to diverse consumer needs, thereby bolstering the Bopet Packaging Films Market.

Growth of the Food and Beverage Sector

The Bopet Packaging Films Market is poised for growth, largely due to the expansion of the food and beverage sector. As consumer preferences shift towards convenience and ready-to-eat meals, the demand for effective packaging solutions that maintain freshness and quality is on the rise. The food and beverage industry is projected to account for a significant portion of the Bopet films market, with estimates suggesting it could represent over 40% of total market share by 2026. This trend underscores the critical role that Bopet films play in ensuring product safety and extending shelf life, thereby driving the industry's growth.

Increased Focus on Sustainable Practices

The Bopet Packaging Films Market is increasingly influenced by a heightened focus on sustainable practices. As environmental concerns gain traction, manufacturers are exploring eco-friendly alternatives and recyclable materials. The shift towards sustainability is not merely a trend but a necessity, as consumers demand transparency and responsibility from brands. This has led to innovations in Bopet films that are not only effective but also environmentally friendly. The market is expected to see a rise in the adoption of biodegradable and recyclable Bopet films, potentially increasing market penetration by 5% over the next few years. This commitment to sustainability is likely to reshape the industry's landscape.

Expansion of E-commerce and Online Retail

The Bopet Packaging Films Market is significantly impacted by the expansion of e-commerce and online retail. As more consumers turn to online shopping, the need for durable and protective packaging solutions has surged. Bopet films are increasingly utilized in shipping and packaging to ensure that products arrive in optimal condition. The e-commerce sector is anticipated to grow at a rate of 10% annually, which will likely drive demand for Bopet films that cater to this market. This trend highlights the importance of robust packaging solutions in enhancing customer satisfaction and reducing return rates, thereby reinforcing the Bopet Packaging Films Market's relevance in the modern retail landscape.

Leave a Comment