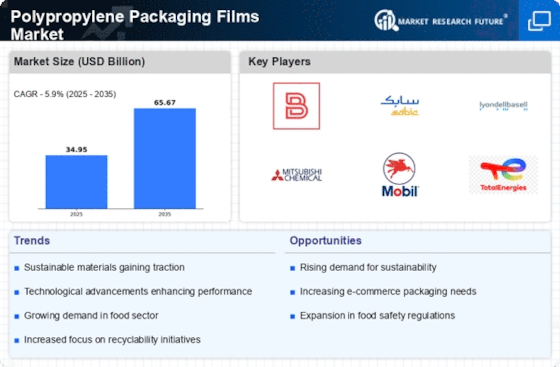

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Polypropylene Packaging Films Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Polypropylene Packaging Films Industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Polypropylene Packaging Films Industry to benefit clients and increase the market sector. In recent years, the Polypropylene Packaging Films Industry has offered some of the most significant advantages to medicine. Major players in the Polypropylene Packaging Films Market, including MITSUI CHEMICALS AMERICA INC., LyondellBasell Industries Holdings, Blueridge Films, Inc., Cosmo Films Ltd., Polyplex Corporation Ltd., TRINIFLEX, Jindal Poly Films, Profol Group, Manuli Stretch s.p.a, Polibak, and Panverta, are attempting to increase market demand by investing in research and development operations.

Max Speciality Films Limited (MSFL), which was established in 1990, has developed into one of the industry's top suppliers of specialty packaging, labels, coatings and thermal lamination films for the Indian and international markets. With the restructure of Max Group, a $2 billion conglomerate, on January 16, 2016, it hopes to maximise shareholder value, narrow the scope of each enterprise, and encourage partnerships that support "Make in India." As of right now, Max Ventures & Industries Limited (MVIL) is the parent company of MSFL.

Modern "R&D centre", BRC "AA" certification, NABL accreditation, ongoing technological advancements, new product development, and a strong dedication to customer service & quality have kept MSFL at the top of the leader board. MSFL has launched the next phase of growth with these major goals in mind, driven by innovation, capacity and portfolio expansion, "best-in-class" customer service, and expanding equity in new markets.

An organization that offers packaging solutions and goods is called Innovia Films Ltd. The business makes plastic packaging items and biaxially oriented polypropylene (BOPP) films. The business provides linerless labels, environmentally friendly labels, packaging made of renewable and biodegradable materials, security films, and tobacco packaging items. For the market for banknotes and securities, it creates polymer substrates. Giant graphic displays, adhesive tapes and labels, as well as specialty packaging for luxury and culinary items, are all uses for these products. It sells its goods under a variety of names, including Rayoface, Rayofoil, RayoForm, and Rayoart.

Operating as a division of CCL Industries Inc. is Innovia. In Europe, Asia-Pacific, and the Americas, the corporation has production facilities and sales offices. Innovia's main office is in Wigton, United Kingdom.