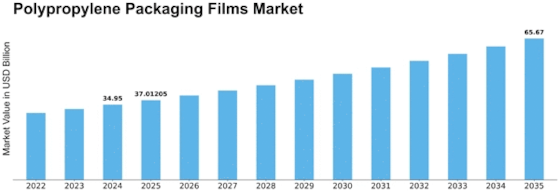

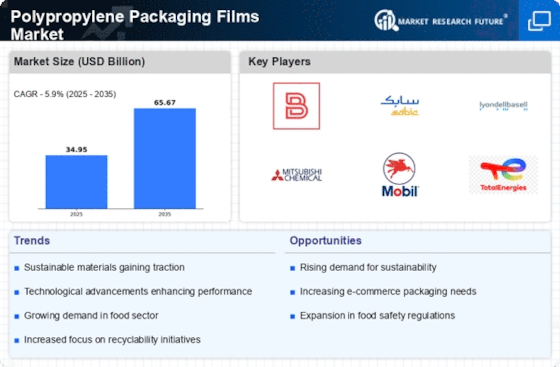

Polypropylene Packaging Films Size

Polypropylene Packaging Films Market Growth Projections and Opportunities

The polypropylene packaging films market is influenced by various market factors that shape its dynamics and growth trajectory. One crucial factor is the growing demand for sustainable and eco-friendly packaging solutions. With increasing awareness about environmental issues, consumers and businesses alike are seeking packaging options that minimize their carbon footprint. Polypropylene films offer a viable solution as they are recyclable and can be reused, reducing overall environmental impact. This trend is driving the adoption of polypropylene packaging films across various industries, including food and beverage, pharmaceuticals, and consumer goods.

Moreover, the rapid expansion of the e-commerce sector is significantly impacting the polypropylene packaging films market. The surge in online shopping has created a heightened demand for robust and flexible packaging materials to ensure safe transit and delivery of products. Polypropylene films offer excellent strength and barrier properties, making them ideal for protecting goods during shipping and handling. As e-commerce continues to flourish globally, the demand for polypropylene packaging films is expected to witness substantial growth in the coming years.

Additionally, technological advancements play a pivotal role in shaping the polypropylene packaging films market. Innovations in film manufacturing processes have led to the development of high-performance films with enhanced properties such as heat resistance, clarity, and sealability. These advancements enable manufacturers to cater to diverse customer requirements and expand their product offerings. Furthermore, innovations in printing technologies have facilitated the customization of polypropylene films with vibrant designs and branding elements, catering to the marketing needs of companies.

Furthermore, economic factors such as fluctuations in raw material prices and currency exchange rates significantly impact the polypropylene packaging films market. Polypropylene, being a derivative of crude oil, is subject to price volatility due to changes in oil prices and supply-demand dynamics. Fluctuations in currency exchange rates also affect the cost of imported raw materials and finished products, influencing pricing strategies and profit margins for market players. Consequently, companies operating in the polypropylene packaging films market must devise effective risk management strategies to mitigate the impact of economic uncertainties.

Moreover, regulatory factors play a crucial role in shaping the polypropylene packaging films market landscape. Governments worldwide are imposing stringent regulations aimed at reducing plastic waste and promoting sustainable packaging alternatives. As a result, there is a growing emphasis on the use of recyclable and biodegradable materials in packaging applications. Manufacturers of polypropylene packaging films are thus compelled to comply with regulatory standards and invest in sustainable practices to ensure environmental compliance and maintain market competitiveness.

Furthermore, shifting consumer preferences and lifestyle changes influence product demand patterns in the polypropylene packaging films market. Changing consumer demographics, urbanization, and evolving consumer lifestyles are driving demand for convenience-oriented packaging solutions such as pouches, sachets, and single-serve packs. Polypropylene films offer flexibility in packaging design and format, making them well-suited for catering to these changing consumer preferences. Additionally, the growing trend of on-the-go consumption and snacking fuels demand for portable and lightweight packaging solutions, further bolstering the market for polypropylene films.

Leave a Comment