Market Trends

Key Emerging Trends in the Polypropylene Packaging Films Market

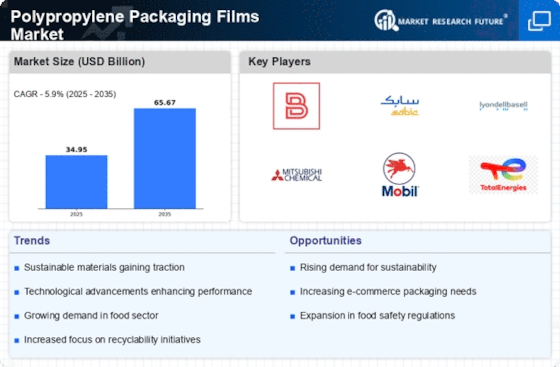

The market trends of polypropylene packaging films indicate a steady growth trajectory driven by several key factors. Polypropylene packaging films are widely used in various industries such as food and beverage, pharmaceuticals, personal care, and others due to their excellent properties such as high tensile strength, flexibility, and moisture resistance. One significant trend in the market is the increasing demand for sustainable packaging solutions. As consumers become more environmentally conscious, there is a growing preference for packaging materials that are recyclable, biodegradable, or made from renewable sources. Polypropylene packaging films, which can be recycled and are compatible with existing recycling infrastructure, are well-positioned to capitalize on this trend.

Another important trend is the rising popularity of flexible packaging formats. Flexible packaging offers several advantages over traditional rigid packaging, including cost savings, lighter weight, and improved shelf life for perishable products. Polypropylene packaging films are ideal for flexible packaging applications as they can be easily customized to meet specific requirements such as barrier properties, printability, and sealability. Additionally, innovations in packaging technology have led to the development of advanced polypropylene films with enhanced functionalities, such as anti-fog, anti-static, and high barrier properties, further driving their adoption in the market.

Furthermore, the growth of the e-commerce industry is also fueling the demand for polypropylene packaging films. With the increasing popularity of online shopping, there is a growing need for durable and protective packaging materials to ensure that products are delivered safely to consumers. Polypropylene films offer excellent puncture resistance and tear strength, making them well-suited for packaging goods during transit. Moreover, advancements in packaging design and printing technologies have enabled brands to create visually appealing packaging solutions that enhance the overall customer experience.

In addition to these trends, the market for polypropylene packaging films is also influenced by macroeconomic factors such as population growth, urbanization, and disposable income levels. As the global population continues to grow, particularly in emerging economies, there is a corresponding increase in the demand for packaged goods. Urbanization further drives this trend, as urban consumers tend to have higher purchasing power and greater access to packaged products. Consequently, manufacturers are ramping up production capacities to meet the growing demand for polypropylene packaging films in these regions.

Moreover, the COVID-19 pandemic has had a significant impact on the polypropylene packaging films market. While the pandemic initially disrupted supply chains and led to fluctuations in demand, it also accelerated certain trends such as the shift towards online shopping and the growing demand for hygienic packaging solutions. As a result, manufacturers have been investing in expanding their production capabilities and developing innovative packaging solutions to meet the evolving needs of consumers in the post-pandemic world.

Looking ahead, the market for polypropylene packaging films is expected to continue growing at a steady pace, driven by the aforementioned trends as well as ongoing technological advancements and regulatory developments. However, manufacturers will need to remain agile and responsive to changing market dynamics, including shifting consumer preferences and emerging sustainability regulations, in order to maintain their competitive edge in the rapidly evolving packaging industry.

Leave a Comment