Research Methodology on Business Processing Outsourcing Services Market

Market Research Future (MRFR), has employed a comprehensive research methodology to assess the market dynamics of Business Process Outsourcing Services. This research methodology is based on primary and secondary data gathered from credible sources such as trade fairs, market reports, catalogues and magazine archives. This process enables a complete market research study with consistent results that is further validated by expert opinion and market feedback.

For a better assessment of the emerging opportunities in the Business Process Outsourcing services market, MRFR has followed a multi-disciplinary approach. This approach involves the following stages:

1. Identification of Target Market -

The first step includes the identification of the target market and its need for Business Process Outsourcing services in terms of products and services.

2. Market Analysis -

This step involves an in-depth study of the competitive landscape. This market analysis helps in understanding the competitive advantages and disadvantages of the leading players in the market. This analysis provides insights into the competitive strategies and tactics employed by the leading players to gain a competitive advantage.

3. Business Model Analysis -

The proposed business models of the leading players in the Business Process Outsourcing services market are assessed and compared. This analysis enables us to understand the business models of the leading players and provide a better analysis of the competitive landscape.

4. Market Drivers and Restraints -

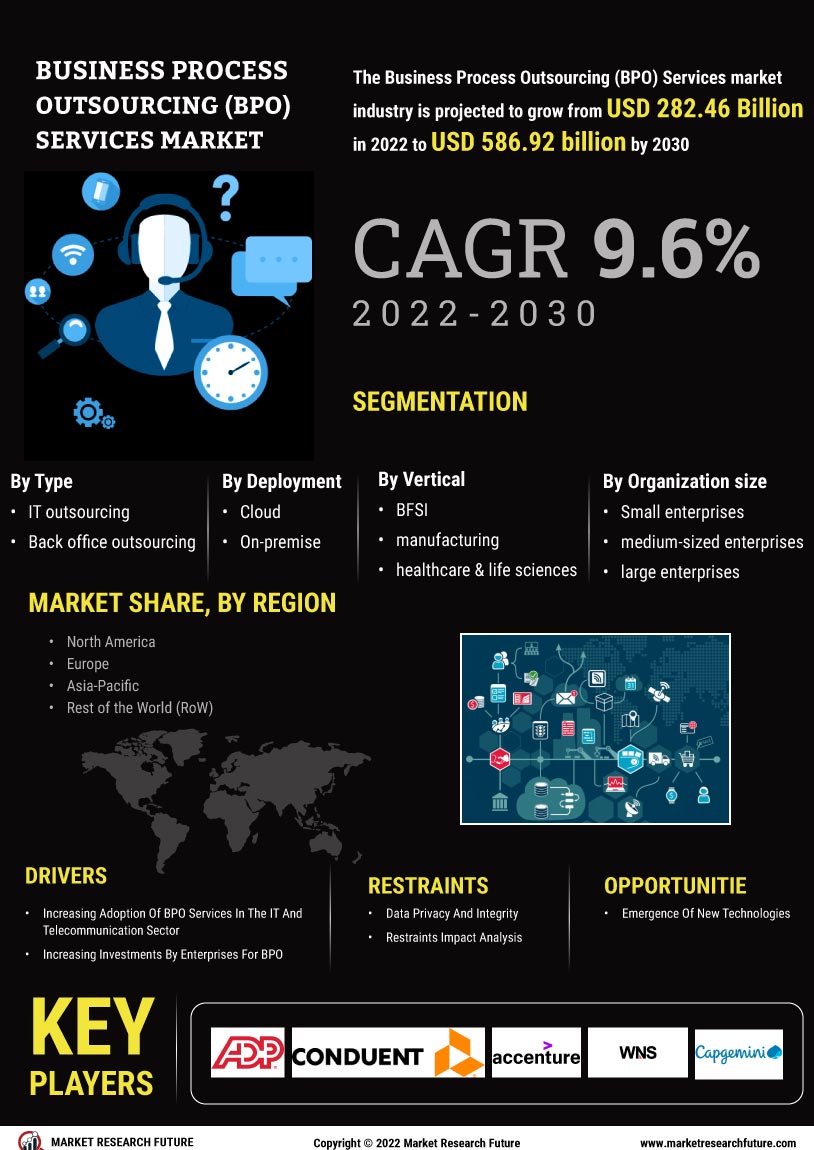

The market drivers and restraints are identified and assessed. The market drivers include factors like demand for services, convenience, cost savings, and efficiency. The market restraints include regulations, infrastructure availability, and cost structure. All these factors are evaluated in order to provide a comprehensive assessment of the market.

5. Technology & Service Delivery -

Technology and service delivery are assessed in order to understand the current trends and technologies used in the market. This analysis enables us to get in-depth insights into the most preferred technologies used by the leading players.

6. Porter’s Five Forces Model -

Porter’s Five Forces Model is used to assess the competitive landscape and analyze the potential strategies the leading players could use to gain a competitive edge in the market. This analysis provides details such as the bargaining power of suppliers, the bargaining power of buyers, threats of new entrants, the threat of substitutes and the industry rivalry.

7. Market Forecast -

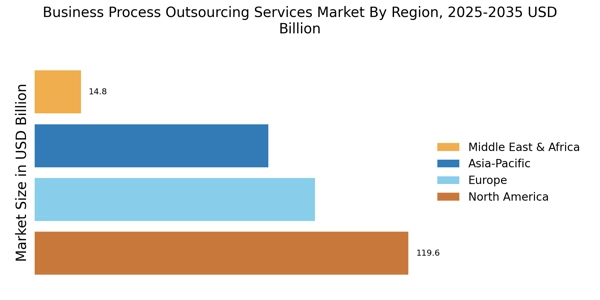

To gain insights into the future growth prospects of the industry, a market forecast is performed. This analysis includes factors such as current factors affecting the industry, market trends and opportunities, industry trends and developments, and macroeconomic conditions.

Overall, this comprehensive research methodology helps in providing an integrated approach to the study of the Business Process Outsourcing Services market. It helps in providing a clear and precise assessment of the market and enables the stakeholders to make effective decisions.