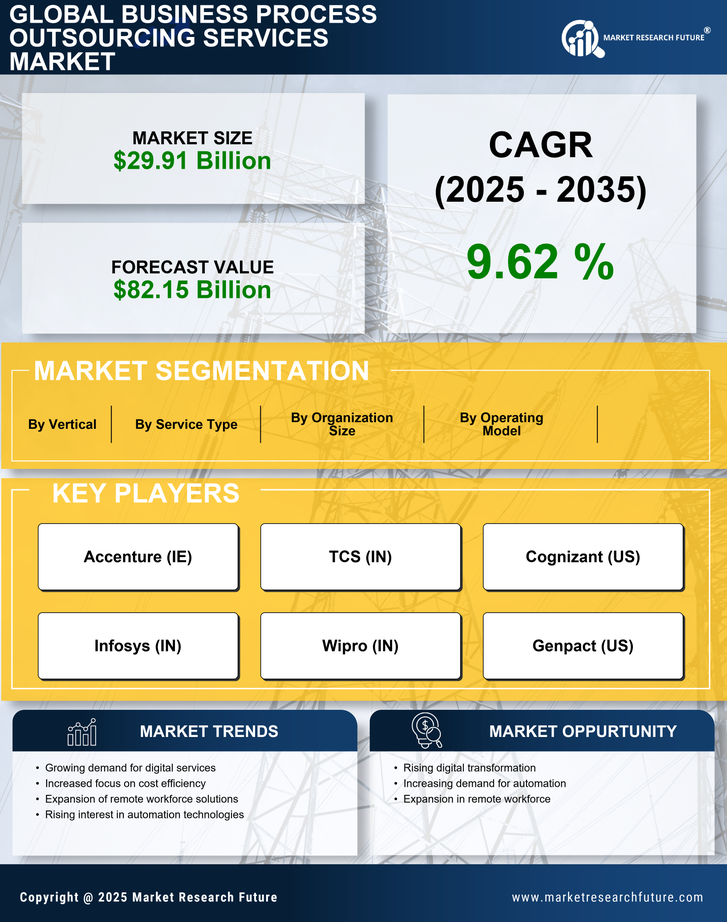

Rising Demand for Cost Efficiency

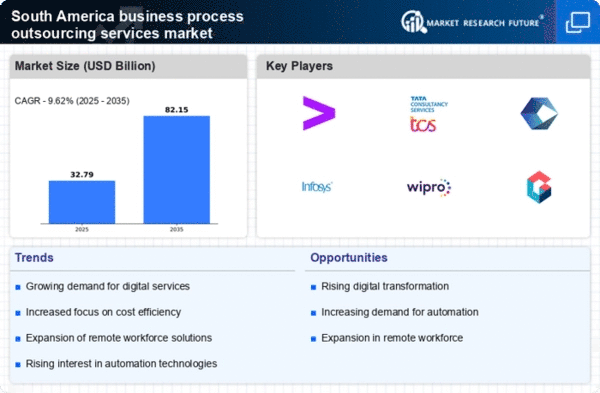

The business process-outsourcing-services market in South America is experiencing a notable surge in demand for cost efficiency. Companies are increasingly seeking to reduce operational costs while maintaining service quality. This trend is driven by the need to remain competitive in a challenging economic environment. For instance, businesses that leverage outsourcing can save up to 30% on operational expenses. As a result, the business process-outsourcing-services market is witnessing a shift towards outsourcing non-core functions, allowing firms to focus on their primary objectives. This demand for cost efficiency is likely to continue shaping the market landscape in the coming years.

Emergence of Niche Service Providers

The business process-outsourcing-services market in South America is witnessing the emergence of niche service providers that cater to specific industry needs. These specialized firms offer tailored solutions that address unique challenges faced by businesses in sectors such as e-commerce, healthcare, and logistics. This trend is indicative of a broader shift towards customization in outsourcing services, allowing companies to benefit from expertise that aligns closely with their operational requirements. As a result, the business process-outsourcing-services market is diversifying, with niche providers playing an increasingly vital role in delivering value-added services.

Increased Focus on Customer Experience

In the competitive landscape of South America, enhancing customer experience has emerged as a critical driver for the business process-outsourcing-services market. Companies are recognizing that superior customer service can lead to increased loyalty and retention. As a result, there is a growing trend towards outsourcing customer support functions to specialized service providers. This shift is evidenced by a 25% increase in demand for customer service outsourcing in the region. By prioritizing customer experience, businesses can differentiate themselves in the market, thereby driving growth within the business process-outsourcing-services market.

Regulatory Compliance and Risk Management

The business process-outsourcing-services market in South America is significantly influenced by the need for regulatory compliance and effective risk management. As regulations become more stringent, companies are turning to outsourcing providers to navigate complex compliance landscapes. This trend is particularly evident in sectors such as finance and healthcare, where adherence to regulations is paramount. The market for compliance-related outsourcing services is expected to grow by 20% over the next five years. Consequently, the business process-outsourcing-services market is adapting to meet these compliance demands, ensuring that clients can mitigate risks effectively.

Expansion of Digital Transformation Initiatives

Digital transformation is becoming a pivotal driver in the business process-outsourcing-services market in South America. Organizations are increasingly adopting advanced technologies such as artificial intelligence, machine learning, and automation to enhance operational efficiency. This shift is reflected in the growing investment in digital solutions, which is projected to reach $50 billion by 2026 in the region. The integration of these technologies into outsourcing services is expected to streamline processes and improve service delivery. Consequently, the business process-outsourcing-services market is evolving to accommodate these technological advancements, positioning itself as a key player in the digital economy.