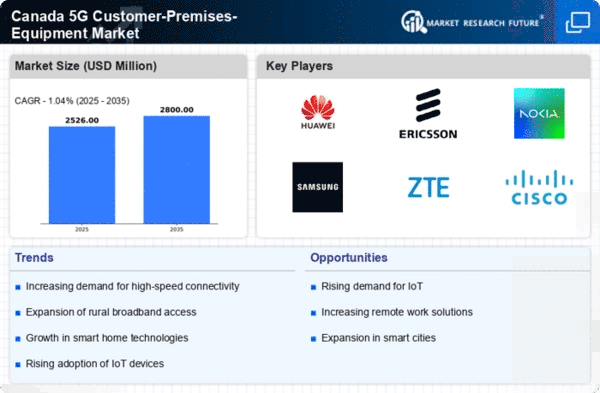

The 5G customer-premises-equipment market in Canada is characterized by a dynamic competitive landscape, driven by rapid technological advancements and increasing demand for high-speed connectivity. Major players such as Huawei (CN), Ericsson (SE), and Nokia (FI) are at the forefront, each adopting distinct strategies to enhance their market presence. Huawei (CN) focuses on innovation and R&D, investing heavily in next-generation technologies, while Ericsson (SE) emphasizes strategic partnerships and regional expansion to bolster its service offerings. Nokia (FI) appears to be concentrating on digital transformation initiatives, aiming to integrate AI and automation into its product lines, thereby enhancing operational efficiency and customer experience. Collectively, these strategies contribute to a competitive environment that is increasingly centered around technological differentiation and customer-centric solutions.

Key business tactics within this market include localizing manufacturing and optimizing supply chains to mitigate risks and enhance responsiveness to market demands. The competitive structure is moderately fragmented, with several key players vying for market share. This fragmentation allows for a diverse range of offerings, yet the influence of major companies remains substantial, as they set industry standards and drive innovation through their extensive resources and capabilities.

In October 2025, Ericsson (SE) announced a strategic partnership with a leading Canadian telecommunications provider to deploy advanced 5G solutions across urban areas. This collaboration is expected to enhance network performance and expand coverage, positioning Ericsson (SE) as a pivotal player in the Canadian market. The strategic importance of this partnership lies in its potential to accelerate the rollout of 5G services, thereby meeting the growing consumer demand for high-speed connectivity.

In September 2025, Nokia (FI) unveiled its latest 5G customer-premises equipment, designed to support enhanced mobile broadband and IoT applications. This launch is significant as it reflects Nokia's commitment to innovation and its ability to respond to evolving market needs. By integrating advanced features into its equipment, Nokia (FI) aims to solidify its competitive edge and attract a broader customer base.

In November 2025, Huawei (CN) revealed plans to invest $1 billion in R&D for 5G technologies in Canada, signaling its long-term commitment to the market. This investment is likely to bolster Huawei's capabilities in developing cutting-edge solutions, thereby enhancing its competitive positioning. The strategic importance of this move lies in its potential to foster innovation and strengthen Huawei's relationships with local stakeholders, which could be crucial in navigating regulatory challenges.

As of November 2025, current competitive trends in the 5G customer-premises-equipment market include a pronounced focus on digitalization, sustainability, and AI integration. Strategic alliances are increasingly shaping the landscape, as companies recognize the value of collaboration in driving innovation and expanding market reach. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition towards a greater emphasis on technological innovation, reliability of supply chains, and the ability to deliver tailored solutions that meet specific customer needs.

Leave a Comment