Rising Cybersecurity Concerns

As the financial sector increasingly relies on digital solutions, cybersecurity has become a paramount concern, driving the AI in Fintech Market in Canada. Financial institutions are investing in AI technologies to bolster their cybersecurity measures, as traditional methods may no longer suffice against sophisticated cyber threats. The implementation of AI-driven security systems can enhance threat detection and response times, potentially reducing the risk of data breaches. Reports suggest that the cost of cybercrime for Canadian businesses could exceed $10 billion annually, underscoring the urgency for robust security solutions. Consequently, the ai in-fintech market is likely to see heightened demand for AI applications that address these cybersecurity challenges, ensuring the protection of sensitive financial data.

Advancements in Data Analytics

The rapid evolution of data analytics technologies is a key driver for the AI in Fintech Market in Canada. Financial institutions are increasingly adopting AI-driven analytics to process vast amounts of data, enabling them to make informed decisions and enhance risk management strategies. The ability to analyze data in real-time allows for more accurate forecasting and improved operational efficiency. Reports indicate that the use of AI in data analytics could reduce operational costs by up to 30% for financial firms. This capability not only streamlines processes but also enhances the overall customer experience, as institutions can respond more swiftly to market changes and customer needs. As a result, the ai in-fintech market is likely to expand as firms invest in advanced analytics solutions.

Regulatory Support for AI Adoption

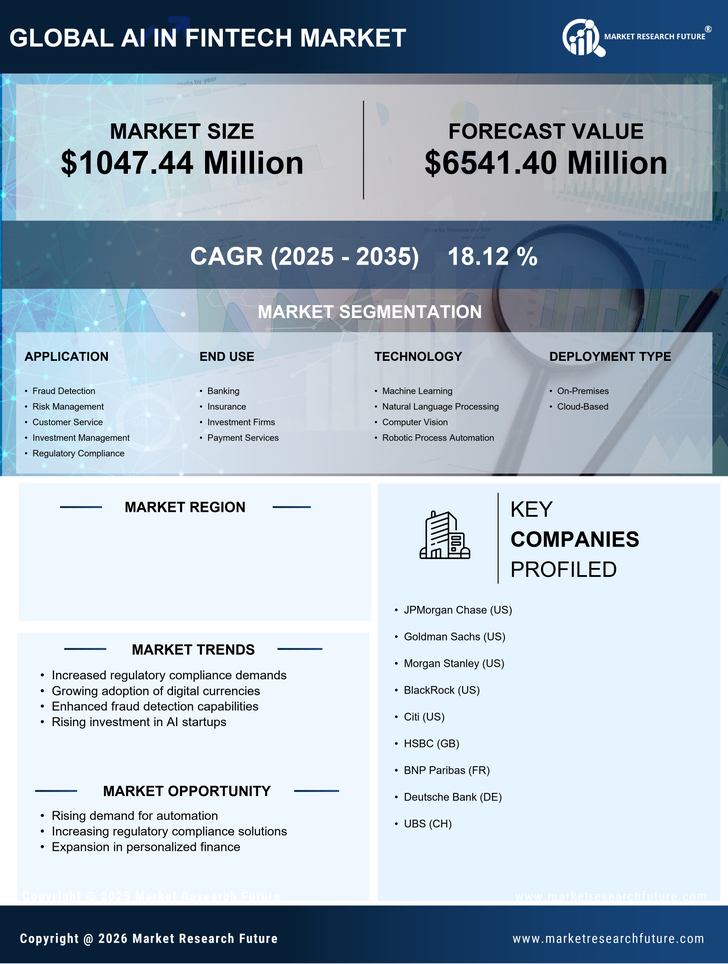

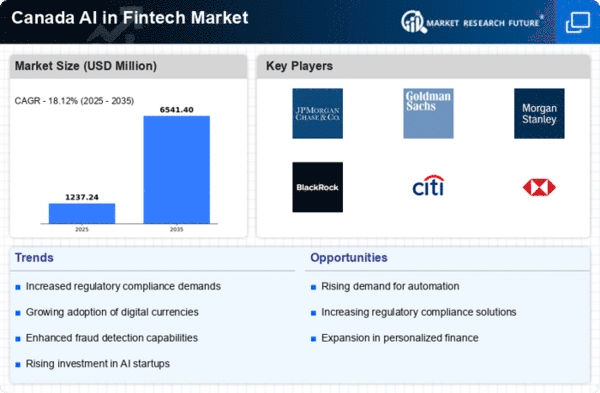

The Canadian government actively promotes the integration of AI technologies within the financial sector, recognizing the potential of the AI in Fintech Market to enhance economic growth. Initiatives such as the Digital Charter and various funding programs aim to foster innovation and ensure compliance with regulatory standards. This supportive environment encourages financial institutions to adopt AI solutions, which can lead to improved customer service and operational efficiencies. As a result, the ai in-fintech market is likely to experience accelerated growth, with investments in AI technologies projected to reach approximately $2 billion by 2026. This regulatory backing not only mitigates risks associated with AI deployment but also instills confidence among stakeholders, thereby driving further investment in the sector.

Increased Investment in Fintech Startups

The Canadian landscape for fintech startups is thriving, with a notable increase in venture capital investment in the AI in Fintech Market. In 2025, investments in fintech startups reached approximately $1.5 billion, reflecting a growing interest in innovative financial solutions powered by AI. This influx of capital enables startups to develop cutting-edge technologies that address various financial challenges, from payment processing to wealth management. The competitive nature of the market encourages collaboration between established financial institutions and emerging startups, fostering an ecosystem conducive to innovation. As these partnerships evolve, the ai in-fintech market is expected to benefit from a diverse range of solutions that enhance efficiency and customer satisfaction.

Growing Demand for Personalized Financial Services

There is an increasing consumer expectation for personalized financial services in Canada, which significantly influences the AI in Fintech Market. Financial institutions are leveraging AI to analyze customer data and deliver tailored products and services. This trend is evident as 70% of consumers express a preference for personalized banking experiences. By utilizing AI algorithms, companies can enhance customer engagement and satisfaction, leading to higher retention rates. The ability to provide customized solutions not only meets consumer demands but also positions firms competitively in a crowded marketplace. Consequently, the ai in-fintech market is poised for growth as institutions invest in AI technologies to refine their offerings and improve customer relationships.