Enhanced Development Speed

The containers as-a-service market in Canada is witnessing a growing emphasis on enhancing development speed. As businesses strive to accelerate their time-to-market, the adoption of containerization technologies is becoming increasingly prevalent. Containers facilitate rapid application development and deployment, allowing teams to iterate quickly and respond to user feedback. This trend is particularly relevant in sectors such as technology and finance, where agility is paramount. Data suggests that organizations utilizing containers can reduce deployment times by up to 50%. Consequently, the containers as-a-service market is becoming an essential component for Canadian companies aiming to maintain a competitive edge in their respective markets.

Growing Demand for Scalability

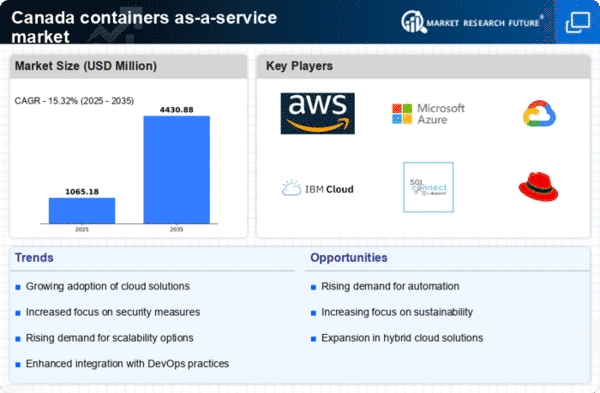

The containers as-a-service market in Canada is experiencing a notable surge in demand for scalability solutions. Organizations are increasingly seeking flexible infrastructure that can adapt to fluctuating workloads. This trend is driven by the need for businesses to respond swiftly to market changes and customer demands. According to recent data, approximately 70% of Canadian enterprises are prioritizing scalable solutions to enhance operational efficiency. The containers as-a-service market is well-positioned to meet this demand, offering services that allow companies to scale their applications seamlessly. This adaptability not only reduces costs but also improves resource utilization, making it a compelling choice for businesses aiming to optimize their IT environments.

Support for Microservices Architecture

The shift towards microservices architecture is significantly influencing the containers as-a-service market in Canada. Organizations are increasingly adopting microservices to enhance their application development processes, enabling them to build and deploy applications as a collection of loosely coupled services. This architectural approach aligns well with containerization, as containers provide an ideal environment for deploying microservices. The containers as-a-service market is thus positioned to support this transition, offering solutions that facilitate the management and orchestration of microservices. As Canadian enterprises continue to embrace this architectural paradigm, the demand for container-based solutions is expected to grow, further solidifying the market's relevance.

Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver for the containers as-a-service market in Canada. Organizations are increasingly recognizing the financial benefits of adopting containerization technologies. By leveraging containers, companies can significantly reduce infrastructure costs, as they require fewer resources compared to traditional virtual machines. Recent studies indicate that businesses utilizing containers can achieve up to 30% savings in operational expenses. This financial incentive is compelling for Canadian enterprises, prompting them to explore the containers as-a-service market as a viable solution for their IT needs. The ability to optimize resource allocation while minimizing costs positions containers as a strategic asset for organizations looking to enhance their bottom line.

Focus on Innovation and Digital Transformation

Innovation and digital transformation are pivotal drivers for the containers as-a-service market in Canada. As organizations seek to modernize their IT infrastructures, the adoption of containerization technologies is becoming increasingly prevalent. This trend is fueled by the need for businesses to innovate rapidly and stay ahead of the competition. The containers as-a-service market plays a crucial role in this transformation, providing the necessary tools and platforms for organizations to develop and deploy innovative applications. Recent surveys indicate that over 60% of Canadian companies view digital transformation as a top priority, further underscoring the importance of containers in facilitating this shift. The market is likely to see continued growth as businesses invest in technologies that support their innovation agendas.