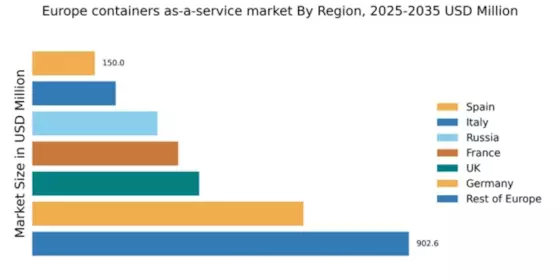

Germany : Strong Growth and Innovation Hub

Germany holds a dominant position in the European containers as-a-service market, with a market value of $650.0 million, representing approximately 25.5% of the total market share. Key growth drivers include a robust industrial base, increasing adoption of cloud technologies, and supportive government initiatives promoting digital transformation. The demand for scalable and flexible IT solutions is rising, driven by sectors such as automotive and manufacturing, which are increasingly leveraging containerization for efficiency. Regulatory frameworks are also evolving to support cloud adoption, enhancing infrastructure development across the country.

UK : Innovation and Investment in Cloud

The UK containers as-a-service market is valued at $400.0 million, accounting for about 15.8% of the European market. Growth is fueled by a strong startup ecosystem, increasing demand for DevOps practices, and significant investments in cloud infrastructure. The UK government has also introduced initiatives to enhance digital skills and promote technology adoption across various sectors. This has led to a surge in demand for container solutions, particularly in finance and healthcare, where agility and compliance are critical.

France : Strong Demand in Tech Sectors

France's market for containers as-a-service is valued at $350.0 million, representing approximately 13.8% of the European market. The growth is driven by the digital transformation of traditional industries and a vibrant tech startup scene. Government initiatives, such as the French Tech program, are fostering innovation and attracting investments in cloud technologies. Demand is particularly strong in sectors like retail and telecommunications, where companies are adopting container solutions to enhance operational efficiency and customer experience.

Russia : Regulatory Landscape and Opportunities

Russia's containers as-a-service market is valued at $300.0 million, making up about 11.8% of the European market. Key growth drivers include the increasing digitization of industries and a push for local data sovereignty. However, regulatory challenges and geopolitical factors can impact market dynamics. Major cities like Moscow and St. Petersburg are at the forefront of cloud adoption, with local players and international firms competing for market share. The demand for container solutions is rising in sectors such as energy and telecommunications, where efficiency is paramount.

Italy : Focus on Digital Transformation

Italy's containers as-a-service market is valued at $200.0 million, representing about 7.9% of the European market. The growth is driven by increasing investments in digital infrastructure and a focus on enhancing IT capabilities across various sectors. Government initiatives aimed at promoting digitalization are also contributing to market expansion. Key markets include Milan and Rome, where businesses are increasingly adopting container solutions to improve operational efficiency and reduce costs. Major players like IBM and Microsoft have a significant presence in this region.

Spain : Investment in Cloud Technologies

Spain's containers as-a-service market is valued at $150.0 million, accounting for approximately 5.9% of the European market. The growth is driven by increasing cloud adoption across various sectors, including tourism and finance. Government initiatives to promote digital transformation and enhance IT infrastructure are also key factors. Major cities like Madrid and Barcelona are leading the charge in cloud adoption, with local startups and international players competing for market share. The demand for container solutions is particularly strong in sectors requiring rapid scalability.

Rest of Europe : Regional Variations in Cloud Adoption

The Rest of Europe represents a significant portion of the containers as-a-service market, valued at $902.6 million, or about 35.5% of the total market. This diverse region includes countries with varying levels of cloud adoption and regulatory environments. Growth is driven by increasing digitalization across sectors such as manufacturing, retail, and healthcare. Countries like the Netherlands and Sweden are leading in cloud innovation, while others are catching up. The competitive landscape features both local and international players, with a focus on tailored solutions for specific industries.