Rising Interest in Quantum Cybersecurity

As cyber threats become more sophisticated, the enterprise quantum-computing market is witnessing a heightened interest in quantum cybersecurity solutions. Organizations are increasingly aware of the potential vulnerabilities posed by quantum computing to traditional encryption methods. Consequently, there is a growing demand for quantum-resistant cryptographic algorithms that can safeguard sensitive data. Canadian companies are investing in research to develop these advanced security measures, which could potentially revolutionize data protection strategies. The market for quantum cybersecurity is expected to grow significantly, with estimates suggesting it could reach $500 million by 2027. This focus on cybersecurity is likely to drive further innovation within the enterprise quantum-computing market.

Government Support and Funding Initiatives

The Canadian government is actively supporting the enterprise quantum-computing market through various funding initiatives and strategic partnerships. Programs aimed at fostering innovation in quantum technologies are being implemented, with significant financial backing allocated to research institutions and startups. For example, the National Research Council of Canada has launched initiatives to promote collaboration between public and private sectors, facilitating the development of quantum applications. This governmental support is crucial, as it not only enhances research capabilities but also encourages private sector investment. As a result, the enterprise quantum-computing market is likely to benefit from increased funding, which could accelerate the pace of technological advancements and commercialization of quantum solutions.

Development of Quantum Talent and Workforce

The enterprise quantum-computing market in Canada is significantly influenced by the development of a skilled workforce capable of advancing quantum technologies. Educational institutions are increasingly offering specialized programs in quantum computing, aiming to equip students with the necessary skills to thrive in this emerging field. Collaborations between universities and industry players are fostering a talent pipeline that addresses the growing demand for quantum experts. Reports indicate that the need for skilled professionals in quantum computing could increase by over 30% in the next five years. This focus on talent development is essential for sustaining growth in the enterprise quantum-computing market, as a well-trained workforce will drive innovation and implementation of quantum solutions.

Growing Demand for Advanced Computing Solutions

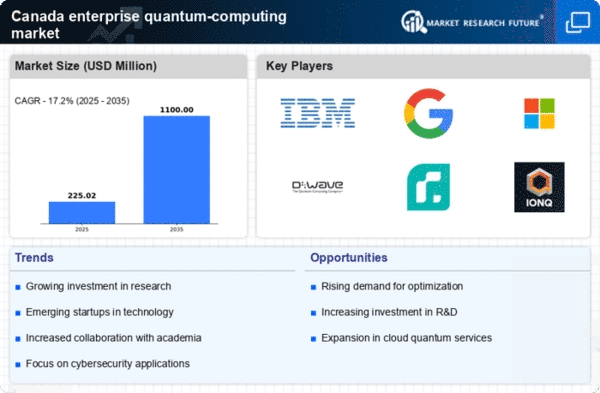

The enterprise quantum-computing market in Canada is experiencing a surge in demand for advanced computing solutions. Industries such as finance, healthcare, and logistics are increasingly seeking quantum computing capabilities to solve complex problems that traditional computing cannot efficiently address. For instance, financial institutions are exploring quantum algorithms for portfolio optimization and risk analysis, which could lead to substantial cost savings and improved decision-making. According to recent estimates, the market for quantum computing in Canada is projected to reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 25%. This growing demand is likely to drive investments in quantum technologies and infrastructure, further propelling the enterprise quantum-computing market forward.

Integration of Quantum Computing with AI Technologies

The integration of quantum computing with artificial intelligence (AI) technologies is emerging as a pivotal driver for the enterprise quantum-computing market in Canada. This convergence has the potential to enhance machine learning algorithms and data processing capabilities, enabling organizations to derive insights from vast datasets more efficiently. Companies are exploring how quantum algorithms can optimize AI models, leading to improved predictive analytics and decision-making processes. The synergy between quantum computing and AI is expected to create new opportunities for innovation across various sectors, including healthcare, finance, and manufacturing. As organizations recognize the benefits of this integration, investments in quantum-AI solutions are likely to increase, further propelling the enterprise quantum-computing market.