Rising Demand for Enhanced Data Security

In Japan, the enterprise quantum-computing market is significantly influenced by the rising demand for enhanced data security. As cyber threats become more sophisticated, organizations are increasingly turning to quantum encryption methods, which offer superior security features compared to classical encryption techniques. Quantum key distribution (QKD) is gaining traction, as it ensures secure communication channels that are theoretically immune to eavesdropping. The market for quantum encryption solutions is expected to reach $1 billion by 2026, reflecting a growing recognition of the need for robust security measures. This trend is particularly relevant for sectors such as finance and healthcare, where data integrity and confidentiality are paramount. Thus, the enterprise quantum-computing market is poised to expand as businesses prioritize security in their digital transformation strategies.

Government Support and Funding Initiatives

The enterprise quantum-computing market in Japan benefits from substantial government support and funding initiatives aimed at fostering innovation. The Japanese government has allocated significant resources to quantum research and development, with investments exceeding $500 million in recent years. This funding is directed towards academic institutions and private enterprises engaged in quantum technology research. Such initiatives not only stimulate technological advancements but also encourage collaboration between academia and industry. The government's commitment to establishing Japan as a leader in quantum technology is likely to attract further investments and talent, thereby accelerating the growth of the enterprise quantum-computing market. As a result, the market is expected to flourish, driven by a conducive ecosystem for innovation and development.

Increased Collaboration Among Industry Players

Collaboration among industry players is emerging as a crucial driver for the enterprise quantum-computing market in Japan. Partnerships between technology firms, research institutions, and startups are fostering knowledge sharing and accelerating the development of quantum solutions. Notably, joint ventures are being formed to tackle complex challenges in quantum algorithm development and hardware integration. This collaborative approach is expected to enhance the pace of innovation, enabling faster deployment of quantum technologies across various sectors. As of 2025, the number of collaborative projects in the quantum space is projected to increase by 40%, reflecting a growing recognition of the need for collective expertise. Consequently, the enterprise quantum-computing market is likely to benefit from a more robust and diverse range of solutions.

Technological Advancements in Quantum Hardware

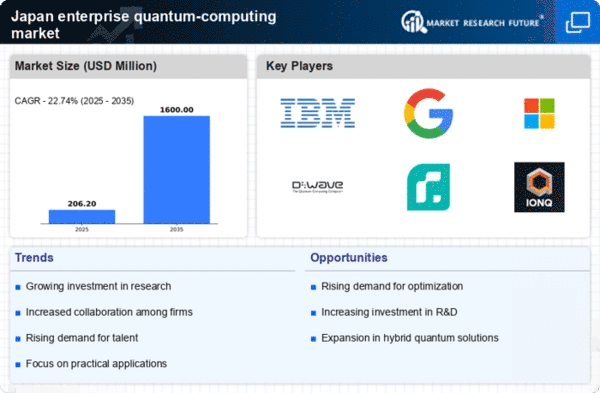

The enterprise quantum-computing market in Japan is experiencing rapid technological advancements in quantum hardware. Innovations in qubit design, error correction, and quantum gate operations are enhancing the performance and reliability of quantum systems. For instance, companies are investing heavily in superconducting qubits and trapped ions, which are pivotal for achieving practical quantum computing capabilities. As of 2025, the market is projected to grow at a CAGR of approximately 30%, driven by these advancements. The increasing demand for high-performance computing solutions across various sectors, including finance and pharmaceuticals, further propels this growth. Consequently, the enterprise quantum-computing market is likely to witness a surge in adoption as organizations seek to leverage these cutting-edge technologies for complex problem-solving.

Growing Interest in Quantum Computing Education

The enterprise quantum-computing market in Japan is witnessing a growing interest in quantum computing education and training programs. As organizations recognize the potential of quantum technologies, there is an increasing demand for skilled professionals who can develop and implement quantum solutions. Educational institutions are responding by introducing specialized courses and degree programs focused on quantum computing. This trend is expected to lead to a more knowledgeable workforce, capable of driving innovation in the enterprise quantum-computing market. By 2026, it is anticipated that the number of graduates in quantum-related fields will increase by 50%, addressing the skills gap in the industry. This influx of talent is likely to enhance the market's growth trajectory, as companies seek to harness the capabilities of quantum computing.