Rising Competitive Pressure

The industrial automation-services market is increasingly influenced by rising competitive pressure among Canadian manufacturers. As globalization intensifies, companies are compelled to enhance their operational efficiency and reduce costs to remain competitive. Automation services offer a viable solution to achieve these objectives, leading to a surge in demand. In 2025, it is projected that the market will expand by 12% as businesses seek to leverage automation to streamline operations and improve productivity. This competitive landscape encourages innovation and the adoption of cutting-edge technologies, further driving growth in the industrial automation-services market.

Focus on Workforce Development

As the industrial automation-services market evolves, there is a notable emphasis on workforce development and training. Canadian companies recognize the importance of equipping their workforce with the necessary skills to operate advanced automation technologies. This focus on training is essential to mitigate potential skill gaps that may arise due to increased automation. In 2025, it is estimated that over 30% of the workforce in manufacturing will require upskilling to adapt to new technologies. Consequently, investments in training programs and partnerships with educational institutions are becoming more prevalent. This commitment to workforce development is likely to enhance the overall effectiveness of automation services in the industrial automation-services market.

Growing Demand for Customization

The industrial automation-services market is witnessing a growing demand for customized automation solutions tailored to specific industry needs. Canadian manufacturers are increasingly seeking automation services that can be adapted to their unique processes and requirements. This trend is particularly pronounced in sectors such as pharmaceuticals and aerospace, where precision and compliance are paramount. The ability to provide bespoke solutions not only enhances operational efficiency but also improves product quality. As companies strive for differentiation in a competitive landscape, the demand for customized automation services is likely to drive growth in the industrial automation-services market.

Government Initiatives and Support

Government initiatives play a pivotal role in shaping the industrial automation-services market in Canada. Various programs and funding opportunities are available to support businesses in adopting automation technologies. For instance, the Canadian government has allocated over $1 billion to promote innovation and technology adoption in manufacturing. This financial backing encourages companies to invest in automation services, thereby enhancing their competitiveness. Furthermore, regulatory frameworks are evolving to facilitate the integration of automation in various sectors. As a result, the industrial automation-services market is expected to benefit from increased government support, fostering growth and innovation.

Technological Advancements in Automation

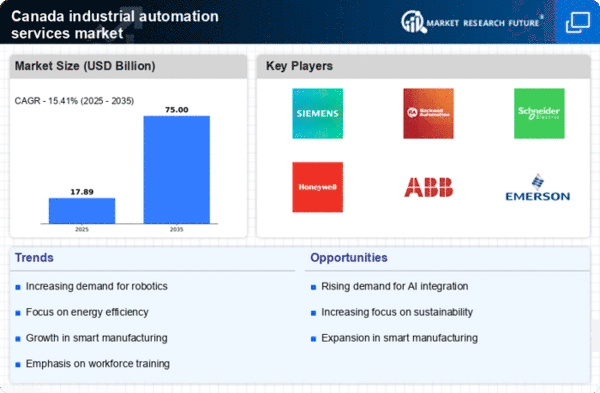

The industrial automation-services market is experiencing a surge in technological advancements, particularly in robotics and IoT. These innovations enhance operational efficiency and reduce labor costs, which is crucial for Canadian manufacturers. In 2025, the market is projected to grow by approximately 15%, driven by the adoption of smart technologies. Companies are increasingly investing in automation solutions to streamline processes and improve productivity. This trend is particularly evident in sectors such as automotive and food processing, where automation can lead to significant cost savings. As Canadian industries embrace these technologies, the demand for automation services is likely to rise, further propelling the industrial automation-services market.