Growing Focus on Supply Chain Optimization

The industrial automation-services market is witnessing a growing focus on supply chain optimization in South America. Companies are increasingly recognizing the importance of efficient supply chain management to enhance overall operational performance. Automation solutions are being adopted to streamline logistics, inventory management, and production scheduling. This trend is particularly relevant in industries such as food and beverage, where timely delivery and quality control are critical. As businesses strive to improve their supply chain processes, the demand for automation services is expected to rise, further propelling the growth of the industrial automation-services market.

Increased Investment in Smart Manufacturing

Investment in smart manufacturing is becoming a key driver for the industrial automation-services market in South America. Companies are increasingly allocating resources towards the implementation of smart technologies that facilitate real-time data analysis and decision-making. This shift towards smart manufacturing is expected to enhance productivity and reduce operational costs. According to recent estimates, the smart manufacturing market in South America is projected to reach $10 billion by 2027, indicating a robust growth trajectory. Consequently, the industrial automation-services market is likely to benefit from this trend, as businesses seek to integrate automation solutions that align with their smart manufacturing initiatives.

Government Initiatives Supporting Automation

Government initiatives in South America are playing a pivotal role in fostering the growth of the industrial automation-services market. Various countries are implementing policies aimed at promoting technological advancements and automation in industries. For instance, investment incentives and grants for automation projects are becoming more prevalent. These initiatives not only encourage businesses to adopt automation solutions but also aim to enhance the overall competitiveness of the region's industries. As a result, the industrial automation-services market is likely to benefit from increased funding and support, facilitating the adoption of innovative technologies across various sectors.

Rising Demand for Automation in Manufacturing

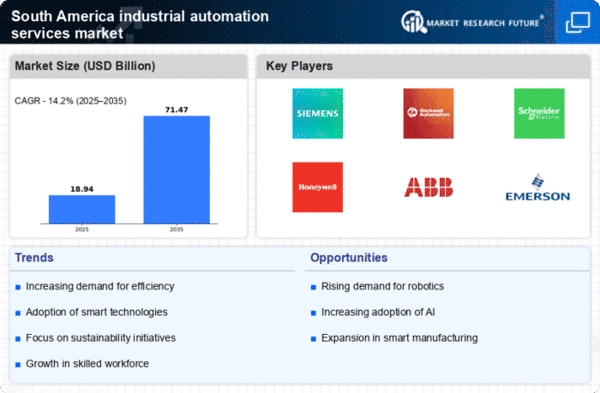

The industrial automation-services market in South America is experiencing a notable surge in demand, particularly within the manufacturing sector. This trend is driven by the need for enhanced productivity and efficiency. As companies strive to remain competitive, they are increasingly adopting automation technologies to streamline operations. Recent data indicates that the manufacturing sector in South America is projected to grow at a CAGR of approximately 6% over the next five years. This growth is likely to propel the industrial automation-services market, as manufacturers seek to integrate advanced automation solutions to optimize production processes and reduce operational costs.

Technological Advancements in Automation Solutions

Technological advancements are significantly influencing the industrial automation-services market in South America. Innovations in robotics, artificial intelligence, and machine learning are enabling companies to implement more sophisticated automation solutions. These technologies are not only improving operational efficiency but also enhancing the quality of products and services. The integration of smart technologies is expected to drive the market forward, as businesses seek to leverage these advancements to gain a competitive edge. As a result, the industrial automation-services market is poised for growth, with companies increasingly investing in cutting-edge automation technologies.