Rising Cyber Threat Landscape

The managed security-services market in Canada is experiencing growth due to an escalating cyber threat landscape. Organizations are increasingly targeted by sophisticated cyber attacks, which necessitate robust security measures. In 2025, it is estimated that cybercrime could cost Canadian businesses over $10 billion annually. This alarming trend compels companies to seek managed security services to safeguard their digital assets. The demand for proactive threat detection and incident response services is surging, as businesses recognize the importance of protecting sensitive data. Consequently, the managed security-services market is likely to expand as organizations prioritize cybersecurity investments to mitigate risks associated with data breaches and cyber threats.

Regulatory Compliance Pressures

In Canada, regulatory compliance is a significant driver for the managed security-services market. Organizations are increasingly required to adhere to stringent regulations such as the Personal Information Protection and Electronic Documents Act (PIPEDA) and the General Data Protection Regulation (GDPR). Non-compliance can result in hefty fines, which may reach up to $100,000 for organizations. As a result, businesses are turning to managed security services to ensure compliance with these regulations. The managed security-services market is likely to benefit from this trend, as service providers offer tailored solutions to help organizations navigate complex compliance landscapes and avoid potential penalties.

Increased Investment in Cybersecurity

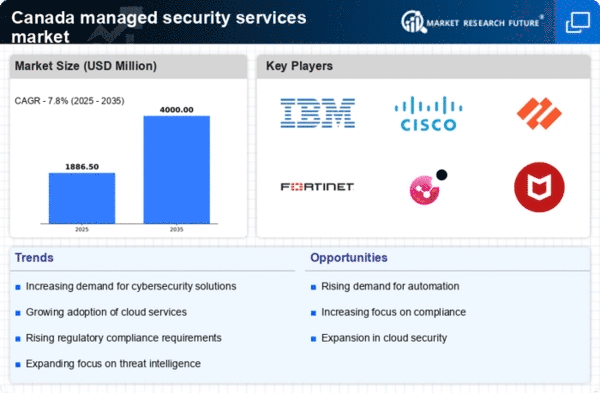

Investment in cybersecurity is on the rise in Canada, significantly impacting the managed security-services market. Organizations are allocating larger portions of their IT budgets to cybersecurity measures, with an expected increase of 15% in spending by 2025. This trend reflects a growing recognition of the importance of cybersecurity in safeguarding business operations. Managed security services are becoming a preferred option for many organizations, as they provide access to advanced security technologies and expertise without the need for substantial in-house resources. As businesses continue to prioritize cybersecurity investments, the managed security-services market is poised for substantial growth.

Growing Demand for Remote Work Security

The shift towards remote work in Canada has created a pressing need for enhanced security measures, driving the managed security-services market. As more employees work from home, organizations face increased vulnerabilities, making it essential to secure remote access to corporate networks. In 2025, it is projected that 30% of the Canadian workforce will continue to work remotely, necessitating robust security solutions. Managed security services can provide comprehensive protection, including secure VPNs, endpoint security, and continuous monitoring. This growing demand for remote work security is likely to propel the managed security-services market as organizations seek to protect their assets in a distributed work environment.

Technological Advancements in Security Solutions

Technological advancements are reshaping the managed security-services market in Canada. Innovations such as artificial intelligence, machine learning, and automation are enhancing the capabilities of security services. These technologies enable faster threat detection and response, improving overall security posture for organizations. In 2025, it is anticipated that AI-driven security solutions will account for over 25% of the managed security-services market. As organizations seek to leverage these advancements, the demand for managed security services that incorporate cutting-edge technologies is likely to increase. This trend suggests a dynamic evolution within the managed security-services market, driven by the need for more effective and efficient security solutions.