Increased Cloud Adoption

The managed security-services market in South America is significantly influenced by the rapid adoption of cloud technologies. As businesses migrate to cloud-based solutions, they face new security challenges that necessitate specialized expertise. In 2025, it is estimated that over 70% of organizations in the region will utilize cloud services, creating a pressing need for managed security services to protect these environments. Cloud security breaches can lead to substantial financial losses and reputational damage, prompting companies to seek external expertise. Managed security service providers are well-positioned to offer tailored solutions that address the unique vulnerabilities associated with cloud infrastructures. This trend is likely to drive substantial growth in the managed security-services market, as organizations prioritize securing their cloud assets.

Rising Cyber Threat Landscape

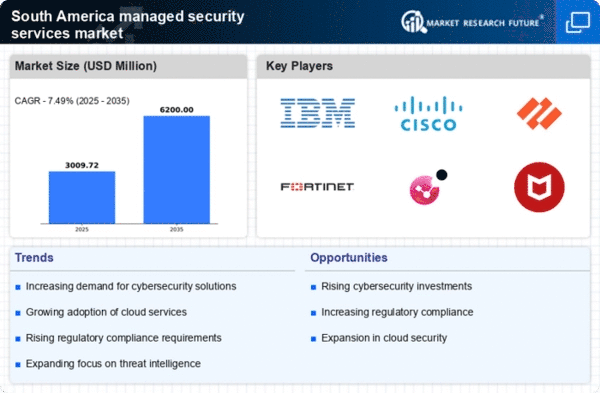

The managed security-services market in South America is experiencing growth due to an escalating cyber threat landscape. Cyberattacks have become increasingly sophisticated, targeting various sectors including finance, healthcare, and government. In 2025, it is estimated that cybercrime could cost the region upwards of $150 billion annually, prompting organizations to seek robust security solutions. This urgency to protect sensitive data and maintain operational integrity drives demand for managed security services. Companies are recognizing that traditional security measures are insufficient, leading to a shift towards comprehensive managed services that offer real-time monitoring and incident response. As a result, the managed security-services market is likely to expand significantly, with a projected CAGR of 12% over the next five years.

Regulatory Compliance Pressures

In South America, regulatory compliance is becoming a critical driver for the managed security-services market. Governments are implementing stricter data protection laws, such as the General Data Protection Law in Brazil, which mandates organizations to safeguard personal data. Non-compliance can result in hefty fines, reaching up to 2% of a company's annual revenue. This regulatory environment compels businesses to invest in managed security services to ensure adherence to legal requirements. As organizations strive to avoid penalties and protect their reputations, the demand for specialized security services that can navigate complex compliance landscapes is expected to rise. Consequently, the managed security-services market is projected to grow as companies seek to align their security strategies with regulatory expectations.

Growing Awareness of Cybersecurity Risks

There is a notable increase in awareness regarding cybersecurity risks among businesses in South America, which is driving the managed security-services market. Organizations are beginning to understand the potential impact of cyber threats on their operations and financial stability. Surveys indicate that approximately 60% of companies in the region have experienced a cyber incident in the past year, highlighting the urgent need for effective security measures. This heightened awareness is leading to increased investments in managed security services, as businesses seek to bolster their defenses against evolving threats. The managed security-services market is likely to benefit from this trend, as companies prioritize proactive security strategies to mitigate risks and protect their assets.

Technological Advancements in Security Solutions

Technological advancements are playing a pivotal role in shaping the managed security-services market in South America. Innovations such as artificial intelligence, machine learning, and automation are enhancing the capabilities of security solutions, enabling faster threat detection and response. As organizations seek to leverage these technologies, the demand for managed security services that incorporate advanced tools is on the rise. In 2025, it is projected that the market for AI-driven security solutions will grow by 25%, reflecting the increasing reliance on technology to combat cyber threats. This trend suggests that managed security service providers must continuously evolve their offerings to remain competitive and meet the changing needs of businesses in the region.