Integration of Advanced Technologies

The integration of advanced technologies is a pivotal driver for the operational analytics market in Canada. As organizations increasingly adopt technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning, the demand for operational analytics solutions is likely to rise. These technologies enable businesses to collect and analyze vast amounts of data in real-time, facilitating more informed decision-making processes. In fact, a recent report indicates that the Canadian market for AI in analytics is projected to reach $2 billion by 2026, highlighting the growing importance of these technologies in the operational analytics market. This integration not only enhances operational efficiency but also allows organizations to respond swiftly to market changes, thereby solidifying their position in a competitive landscape.

Growing Emphasis on Customer Experience

The operational analytics market in Canada is witnessing a growing emphasis on enhancing customer experience. Businesses are increasingly utilizing analytics to gain insights into customer behavior, preferences, and feedback. This focus on customer-centric strategies is driving the demand for operational analytics solutions that can provide actionable insights. According to industry reports, organizations that prioritize customer experience are likely to see a 10-15% increase in customer retention rates. As a result, companies are investing in operational analytics tools that enable them to analyze customer interactions and optimize their service delivery. This trend not only fosters customer loyalty but also positions organizations to adapt to changing consumer expectations, thereby propelling growth within the operational analytics market.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are increasingly influencing the operational analytics market in Canada. As businesses face stringent regulations across various industries, the need for robust analytics solutions to ensure compliance is paramount. Organizations are leveraging operational analytics to monitor compliance metrics and identify potential risks proactively. This trend is particularly evident in sectors such as finance and healthcare, where regulatory requirements are complex and constantly evolving. The operational analytics market is expected to benefit from this focus on compliance, as companies invest in analytics tools that provide real-time insights into their operations. Furthermore, the ability to mitigate risks through data-driven strategies is likely to enhance the overall resilience of organizations operating within the Canadian market.

Rising Demand for Data-Driven Decision Making

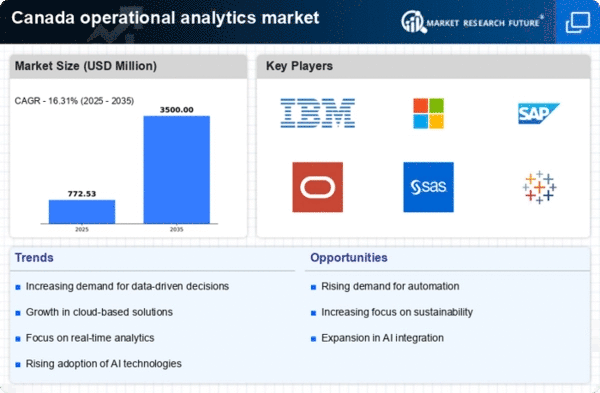

the operational analytics market is experiencing a notable surge in demand for data-driven decision making. Organizations across various sectors are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and drive strategic initiatives. According to recent studies, approximately 70% of Canadian businesses are prioritizing data analytics as a core component of their operational strategies. This trend is likely to propel the operational analytics market forward, as companies seek to harness insights from their data to optimize processes, reduce costs, and improve customer satisfaction. The emphasis on data-driven decision making is expected to foster innovation and competitiveness within the operational analytics market, as firms invest in advanced analytics tools and technologies to gain a competitive edge.

Increased Investment in Digital Transformation

Increased investment in digital transformation initiatives is a key driver of the operational analytics market in Canada. Organizations are recognizing the necessity of adopting digital technologies to remain competitive in an evolving marketplace. This shift towards digitalization is prompting businesses to invest in operational analytics solutions that facilitate data integration, process automation, and performance monitoring. Recent data suggests that Canadian companies are expected to allocate over $15 billion towards digital transformation projects by 2026. This influx of investment is likely to enhance the capabilities of the operational analytics market, as firms seek to leverage analytics for improved operational performance and strategic decision-making. The focus on digital transformation is anticipated to create new opportunities for innovation and growth within the operational analytics landscape.