Rising Operational Costs

The telecom expense-management market in Canada is experiencing a notable surge in demand due to rising operational costs faced by businesses. As companies strive to optimize their expenditures, the need for effective telecom expense management solutions becomes increasingly critical. In 2025, it is estimated that operational costs in the telecom sector could rise by approximately 15%, prompting organizations to seek innovative ways to manage their telecom expenses. This trend indicates a growing recognition of the importance of telecom expense-management solutions in controlling costs and enhancing financial efficiency. Consequently, businesses are investing in advanced tools and services that provide visibility and control over telecom spending, thereby driving growth in the telecom expense-management market.

Shift Towards Remote Work

The shift towards remote work in Canada has created a substantial impact on the telecom expense-management market. With an increasing number of employees working from home, organizations are facing new challenges in managing telecom expenses associated with remote communication tools and services. In 2025, it is projected that remote work-related telecom expenses could account for up to 30% of total telecom spending for many businesses. This shift necessitates the implementation of comprehensive telecom expense-management solutions that can effectively track and optimize these expenses. As companies adapt to this new work environment, the demand for telecom expense-management solutions is likely to grow, reflecting the evolving landscape of workplace communication.

Regulatory Compliance Requirements

In Canada, the telecom expense-management market is significantly influenced by stringent regulatory compliance requirements. Organizations are compelled to adhere to various regulations governing telecommunications, which necessitates accurate tracking and management of telecom expenses. The Canadian Radio-television and Telecommunications Commission (CRTC) has implemented regulations that require transparency in billing and service delivery. As a result, companies are increasingly adopting telecom expense-management solutions to ensure compliance and avoid potential penalties. This trend is expected to drive market growth, as businesses recognize the need for robust systems that facilitate compliance with regulatory standards while managing their telecom expenses effectively.

Increased Focus on Cost Optimization

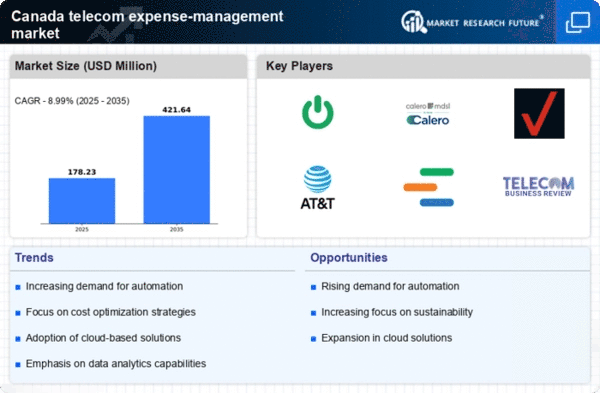

The telecom expense-management market in Canada is witnessing a heightened focus on cost optimization as businesses seek to enhance their financial performance. Organizations are increasingly aware of the need to scrutinize their telecom expenses and identify areas for potential savings. In 2025, it is estimated that companies could save up to 25% on their telecom costs by implementing effective expense-management strategies. This realization is prompting businesses to invest in telecom expense-management solutions that offer comprehensive visibility into spending patterns and facilitate informed decision-making. As a result, the market is likely to experience robust growth, driven by the demand for tools that enable organizations to optimize their telecom expenditures.

Technological Advancements in Telecom

Technological advancements in the telecom sector are playing a pivotal role in shaping the telecom expense-management market in Canada. Innovations such as 5G technology and enhanced mobile applications are transforming how businesses communicate and manage their telecom expenses. As organizations adopt these new technologies, they require sophisticated expense-management solutions that can integrate seamlessly with their existing systems. In 2025, it is anticipated that the adoption of 5G will lead to a 20% increase in data usage, further complicating expense management. Consequently, businesses are increasingly investing in telecom expense-management solutions that leverage these advancements to provide real-time insights and analytics, thereby driving market growth.