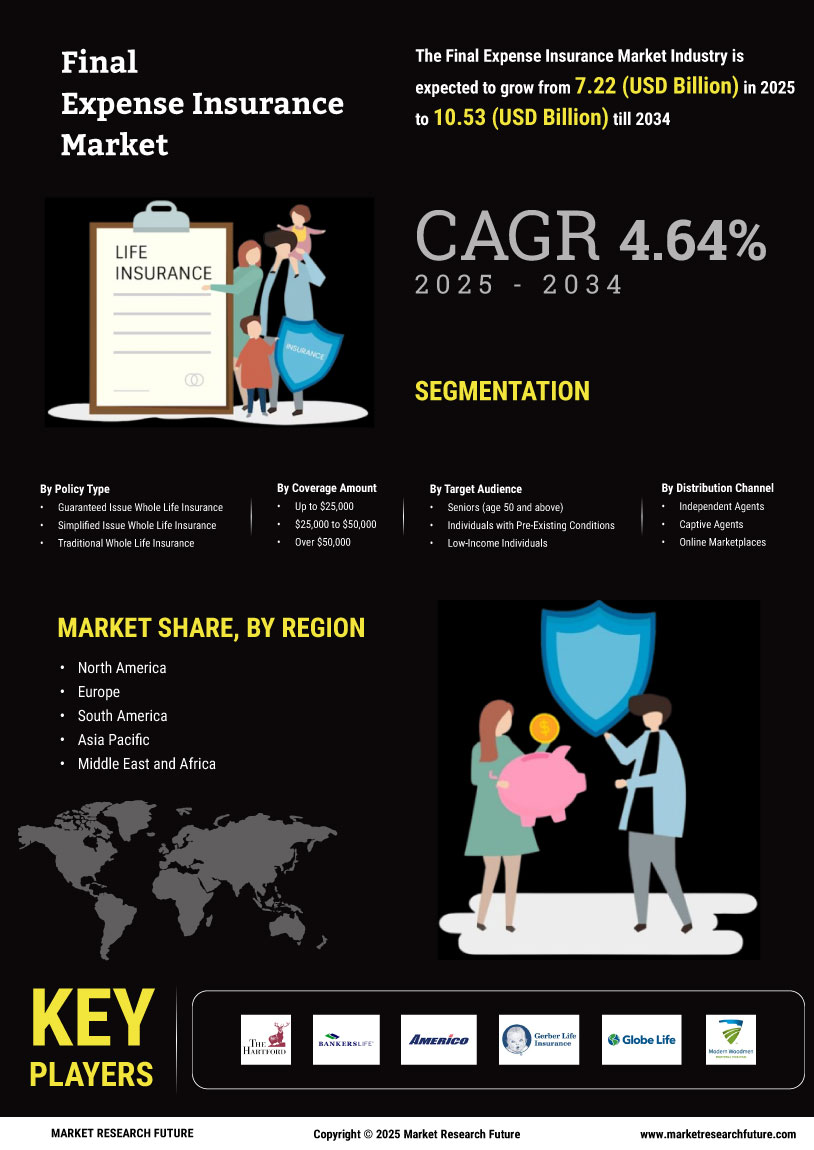

Aging Population

The aging population is a primary driver of the Final Expense Insurance Market. As life expectancy increases, a larger segment of the population is reaching advanced ages, leading to a heightened awareness of the need for financial planning related to end-of-life expenses. In many regions, individuals aged 65 and older are projected to double by 2050, creating a substantial demand for final expense insurance products. This demographic shift indicates that more people are seeking ways to alleviate the financial burden on their families after their passing. Consequently, insurance providers are adapting their offerings to cater to this growing market, ensuring that final expense insurance becomes a staple in financial planning for older adults.

Rising Funeral Costs

Rising funeral costs serve as a significant catalyst for the Final Expense Insurance Market. The average cost of a funeral has seen a steady increase over the years, with estimates suggesting that the average expense can exceed $7,000 in many regions. This financial burden can be overwhelming for families, prompting individuals to seek insurance solutions that can cover these costs. As awareness of these rising expenses grows, more consumers are likely to consider final expense insurance as a viable option to ensure their loved ones are not left with unexpected financial responsibilities. This trend indicates a potential for growth in the market as more individuals recognize the importance of pre-planning for funeral expenses.

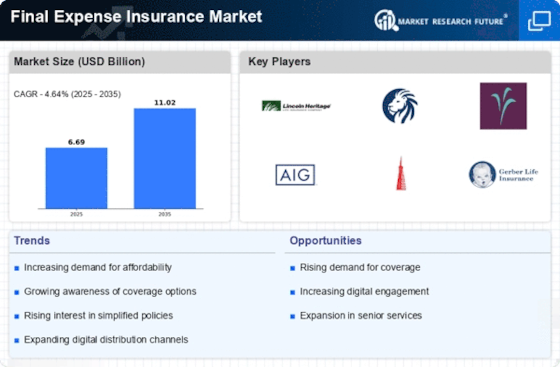

Technological Advancements

Technological advancements are reshaping the Final Expense Insurance Market by enhancing accessibility and efficiency. The rise of digital platforms allows consumers to research, compare, and purchase insurance products online, streamlining the buying process. Insurers are increasingly utilizing technology to offer personalized quotes and improve customer service through chatbots and online consultations. This shift towards digitalization not only attracts tech-savvy consumers but also caters to the preferences of younger generations who are more inclined to engage with online services. As technology continues to evolve, it is likely that the final expense insurance market will see increased competition and innovation, ultimately benefiting consumers.

Increased Financial Literacy

Increased financial literacy among consumers is influencing the Final Expense Insurance Market positively. As individuals become more educated about financial products and planning, they are more likely to consider insurance options that address end-of-life costs. Educational initiatives and resources have made it easier for consumers to understand the benefits of final expense insurance, leading to a rise in policy purchases. Reports indicate that a significant percentage of consumers now actively seek information about financial products, including insurance, which suggests a growing market for final expense solutions. This trend may lead to a more informed consumer base that prioritizes financial preparedness for their families.

Changing Attitudes Towards Death and Planning

Changing attitudes towards death and planning are influencing the Final Expense Insurance Market. Societal norms are shifting, with more individuals recognizing the importance of planning for end-of-life expenses. This change is partly driven by cultural movements that encourage open discussions about death and financial preparedness. As people become more comfortable addressing these topics, the demand for final expense insurance is likely to increase. Additionally, the growing trend of pre-planning funerals and memorial services indicates a shift in consumer behavior, suggesting that individuals are more proactive in ensuring their families are not burdened with financial stress. This evolving mindset may lead to a more robust market for final expense insurance.