Evolving Consumer Behavior

The transaction monitoring market is also influenced by the evolving behavior of consumers in Canada. With the rise of digital banking and e-commerce, consumers are increasingly engaging in online transactions. This shift necessitates advanced monitoring systems to track and analyze transaction patterns effectively. In 2025, it is projected that online transactions will account for over 50% of all retail sales in Canada. Consequently, financial institutions must adapt their transaction monitoring strategies to accommodate this change, ensuring they can identify suspicious activities and enhance customer experience. This evolution in consumer behavior is a key driver for the transaction monitoring market.

Regulatory Landscape Changes

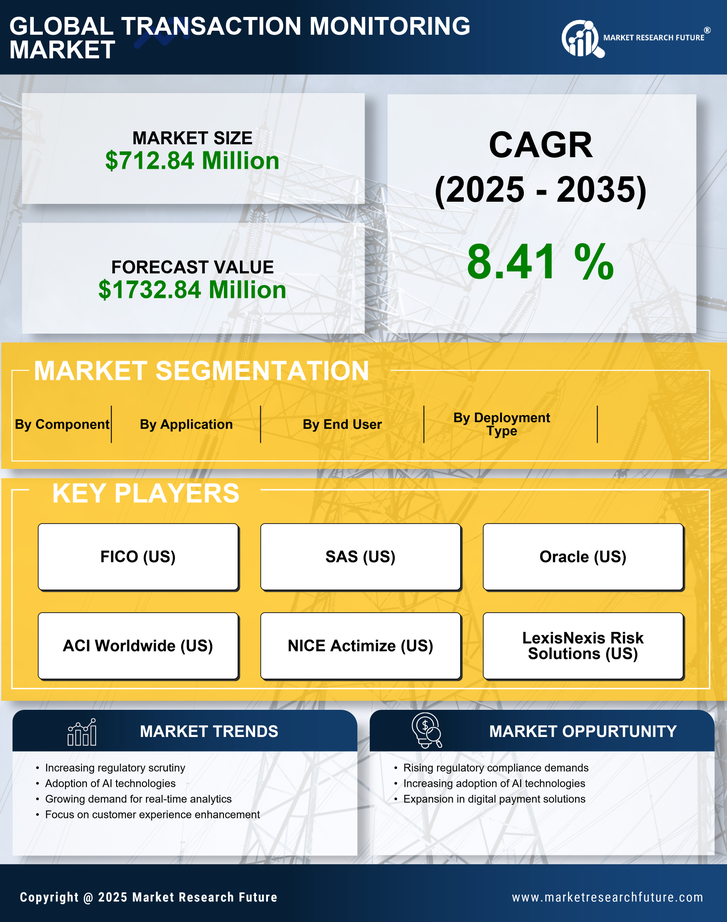

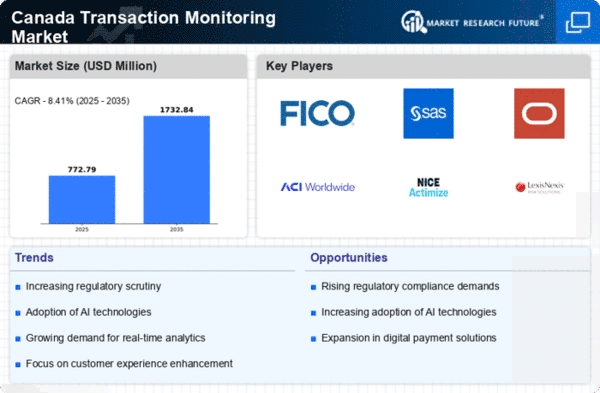

In Canada, changes in the regulatory landscape impact the market. is significantly impacted by changes in the regulatory landscape. Authorities are continuously updating compliance requirements to combat money laundering and terrorist financing. In 2025, it is anticipated that the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) will implement stricter guidelines for transaction monitoring practices. This regulatory pressure compels financial institutions to enhance their monitoring capabilities, leading to increased investments in advanced technologies. As organizations strive to meet compliance standards, the transaction monitoring market is expected to expand, driven by the need for effective solutions that align with evolving regulations.

Increasing Cybersecurity Threats

In Canada, heightened demand due to increasing prevalence of cybersecurity threats. is experiencing heightened demand due to the increasing prevalence of cybersecurity threats. Financial institutions are under constant pressure to safeguard sensitive customer data and prevent fraudulent activities. In 2025, it is estimated that cybercrime could cost the Canadian economy over $3 billion annually. This alarming trend compels organizations to invest in robust transaction monitoring solutions that can detect and mitigate potential threats in real-time. As a result, the transaction monitoring market is likely to see significant growth as businesses prioritize cybersecurity measures to protect their assets and maintain customer trust.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into transaction monitoring systems is transforming the market landscape in Canada. AI technologies enable financial institutions to analyze vast amounts of transaction data quickly and accurately, identifying anomalies that may indicate fraudulent activities. In 2025, it is projected that AI-driven solutions will account for approximately 30% of the transaction monitoring market. This shift towards automation not only enhances efficiency but also reduces operational costs for organizations. As AI continues to evolve, its adoption in the transaction monitoring market is likely to accelerate, providing businesses with sophisticated tools to combat financial crime.

Growing Demand for Real-Time Monitoring

The demand for real-time transaction monitoring solutions is on the rise in Canada, driven by the need for immediate detection of suspicious activities. Financial institutions are increasingly recognizing the importance of timely responses to potential threats. In 2025, it is estimated that over 60% of organizations will prioritize real-time monitoring capabilities in their transaction monitoring strategies. This trend reflects a broader shift towards proactive risk management, where businesses aim to mitigate risks before they escalate. As a result, the transaction monitoring market is expected to grow, with a focus on developing technologies that facilitate real-time analysis and reporting.