Evolving Consumer Behavior

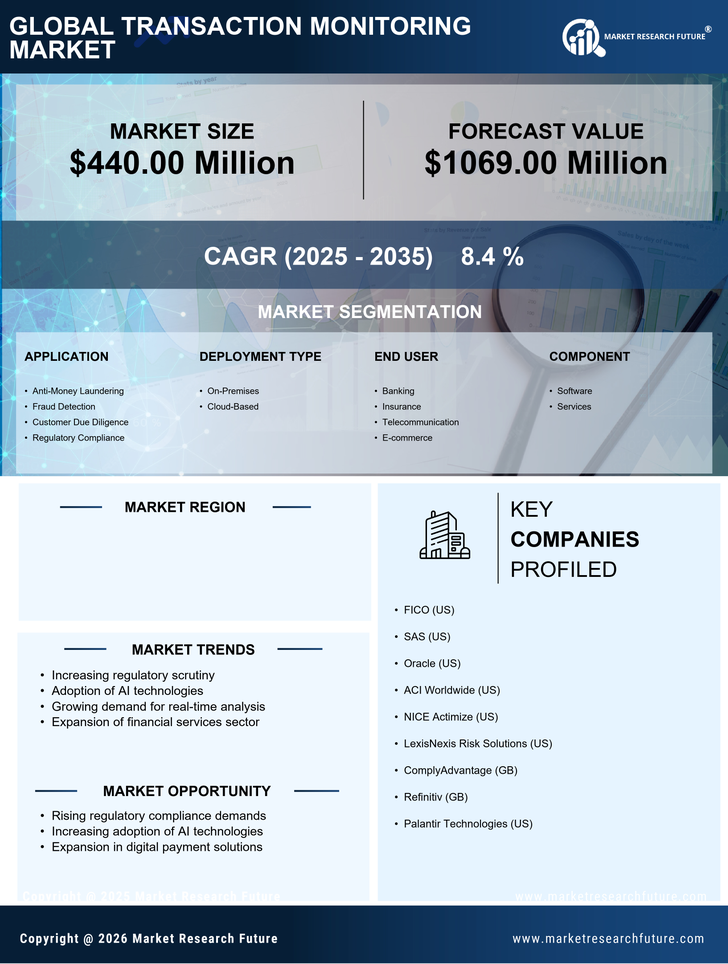

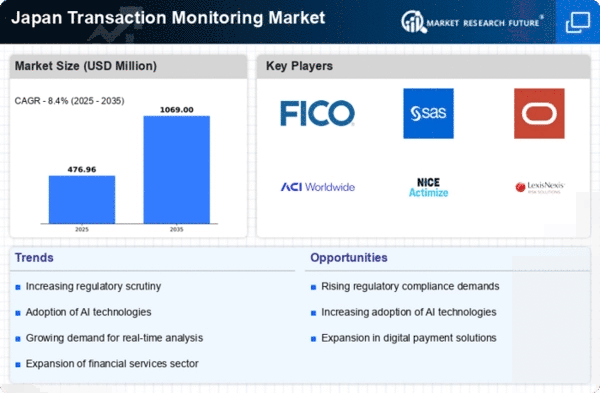

The transaction monitoring market in Japan is significantly influenced by evolving consumer behavior, particularly the shift towards digital transactions. As more consumers opt for online banking and e-commerce, financial institutions must adapt their monitoring systems to address the unique risks associated with these platforms. In 2025, it is projected that digital payments will account for over 70% of all transactions in Japan, necessitating enhanced monitoring capabilities. This shift not only drives the demand for transaction monitoring solutions but also encourages innovation within the industry. Financial institutions are increasingly focusing on real-time monitoring to detect fraudulent activities promptly, thereby ensuring customer trust and regulatory compliance.

Rise of Fintech Innovations

The transaction monitoring market in Japan is being propelled by the rise of fintech innovations. As fintech companies continue to disrupt traditional banking models, they are also introducing new challenges in transaction monitoring. In 2025, it is expected that fintech firms will capture a significant share of the financial services market, leading to increased scrutiny from regulators. This dynamic creates opportunities for transaction monitoring solutions that cater specifically to the needs of fintech companies. The industry is likely to see a surge in demand for agile and scalable monitoring systems that can adapt to the fast-paced nature of fintech operations, ensuring compliance and security.

Regulatory Landscape Changes

The transaction monitoring market in Japan is shaped by ongoing changes in the regulatory landscape. Authorities are continuously updating compliance requirements to combat money laundering and terrorist financing. In 2025, the Financial Action Task Force (FATF) is expected to implement stricter guidelines, compelling financial institutions to enhance their monitoring systems. This regulatory pressure drives investment in advanced transaction monitoring technologies, as institutions seek to avoid hefty fines and reputational damage. The industry is likely to witness a surge in demand for solutions that offer comprehensive reporting and analytics capabilities, enabling institutions to meet compliance standards effectively.

Increasing Cybersecurity Threats

The transaction monitoring market in Japan is experiencing heightened demand due to the increasing prevalence of cybersecurity threats. As financial institutions face sophisticated cyberattacks, the need for robust transaction monitoring systems becomes paramount. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting Japanese banks to invest heavily in advanced monitoring solutions. This trend indicates a growing recognition of the importance of safeguarding sensitive financial data, thereby driving the transaction monitoring market. The industry is likely to see a surge in the adoption of AI and machine learning technologies to enhance threat detection capabilities, ensuring compliance with stringent regulations.

Integration of Advanced Analytics

The transaction monitoring market in Japan is increasingly benefiting from the integration of advanced analytics into monitoring systems. Financial institutions are recognizing the value of data-driven insights to enhance their fraud detection capabilities. By leveraging big data analytics, organizations can identify patterns and anomalies in transaction behavior, leading to more effective monitoring. In 2025, it is anticipated that the market for analytics-driven transaction monitoring solutions will grow by over 25%. This trend suggests that institutions are prioritizing the adoption of technologies that provide actionable intelligence, thereby improving their overall risk management strategies within the transaction monitoring market.