Expansion of Legal Cannabis Markets

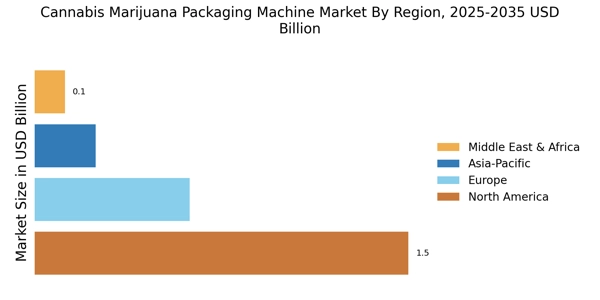

The ongoing expansion of legal cannabis markets is a key driver for the Cannabis Marijuana Packaging Machine Market. As more regions legalize cannabis for medicinal and recreational use, the demand for efficient and compliant packaging solutions is escalating. This trend is particularly evident in North America and parts of Europe, where the legalization movement is gaining momentum. The increase in the number of licensed producers and dispensaries is further fueling the need for specialized packaging machinery that can cater to diverse product offerings. Market analysts suggest that this expansion could lead to a doubling of the packaging machinery market size within the next five years, as businesses seek to capitalize on the burgeoning consumer base.

Regulatory Compliance and Standardization

The Cannabis Marijuana Packaging Machine Market is experiencing a surge in demand due to increasing regulatory compliance requirements. Governments are implementing stringent packaging regulations to ensure product safety and consumer protection. This trend necessitates advanced packaging solutions that can meet these evolving standards. As a result, manufacturers are investing in innovative packaging technologies that not only comply with regulations but also enhance product visibility and branding. The market for cannabis packaging machinery is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by the need for compliance with labeling, child-resistant features, and tamper-evident packaging, which are becoming essential in the industry.

Rising Consumer Demand for Quality Products

Consumer preferences are shifting towards high-quality cannabis products, which is influencing the Cannabis Marijuana Packaging Machine Market. As consumers become more discerning, they seek products that are not only effective but also aesthetically pleasing and well-packaged. This trend is prompting manufacturers to adopt advanced packaging technologies that enhance product appeal and preserve quality. The demand for premium packaging solutions is expected to drive market growth, with a notable increase in the use of eco-friendly materials and innovative designs. Market data indicates that the premium segment of cannabis packaging is expanding rapidly, reflecting a broader trend towards quality and sustainability in consumer goods.

Technological Advancements in Packaging Machinery

Technological innovations are playing a pivotal role in shaping the Cannabis Marijuana Packaging Machine Market. The introduction of automated and semi-automated packaging solutions is enhancing efficiency and reducing labor costs for manufacturers. These advancements allow for faster production rates and improved accuracy in packaging, which are critical in meeting the growing demand for cannabis products. Additionally, the integration of smart technologies, such as IoT and AI, is enabling real-time monitoring and optimization of packaging processes. This technological evolution is expected to propel the market forward, with projections indicating a significant increase in the adoption of advanced packaging machinery over the next few years.

Focus on Sustainability and Eco-Friendly Packaging

Sustainability is becoming a central theme in the Cannabis Marijuana Packaging Machine Market. As environmental concerns rise, consumers and businesses alike are prioritizing eco-friendly packaging solutions. This shift is prompting manufacturers to explore biodegradable materials and recyclable packaging options that minimize environmental impact. The demand for sustainable packaging is not only driven by consumer preferences but also by regulatory pressures aimed at reducing plastic waste. Market trends indicate that companies adopting sustainable practices are likely to gain a competitive edge, as consumers increasingly favor brands that demonstrate environmental responsibility. This focus on sustainability is expected to significantly influence the packaging machinery market, with growth projections indicating a substantial increase in the adoption of eco-friendly packaging technologies.