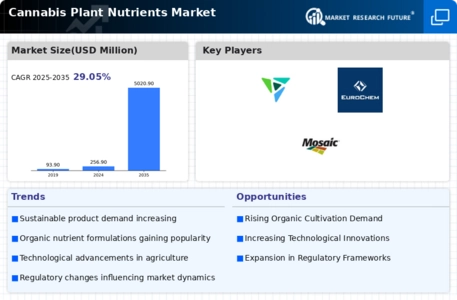

Top Industry Leaders in the Cannabis Plant Nutrients Market

The competitive landscape of the cannabis plant nutrients market has witnessed significant activity in recent years, fueled by the expanding cannabis industry and the increasing recognition of the importance of optimal nutrient solutions for cannabis cultivation.

The competitive landscape of the cannabis plant nutrients market has witnessed significant activity in recent years, fueled by the expanding cannabis industry and the increasing recognition of the importance of optimal nutrient solutions for cannabis cultivation.

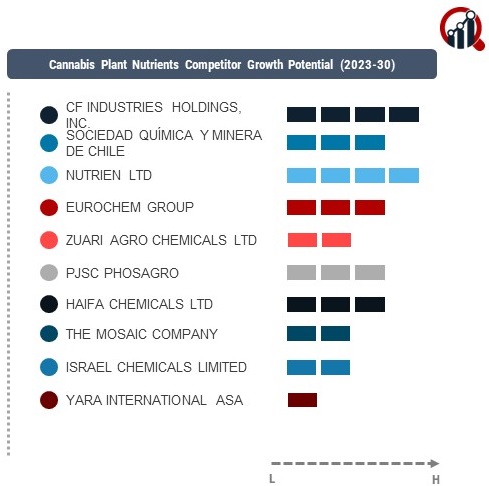

key players dominating this market include

- CF Industries Holdings, Inc. (US)

- Sociedad Química y Minera de Chile (Chile)

- Nutrien Ltd (Canada)

- EuroChem Group (Switzerland)

- Zuari Agro Chemicals Ltd (India)

- PJSC PhosAgro (Russia)

- Haifa Chemicals Ltd (Israel)

- The Mosaic Company (US)

- Israel Chemicals Limited (Israel)

- Yara International ASA (Norway)

Key players in the cannabis plant nutrients market have adopted diverse strategies to secure and enhance their positions. GreenGro Technologies, for instance, has focused on developing organic nutrient solutions, aligning with the growing demand for sustainable and eco-friendly cultivation practices. Advanced Nutrients has implemented an aggressive marketing approach, leveraging partnerships with cannabis cultivators and industry influencers to establish its brand as a go-to choice for high-quality plant nutrients.

Market share analysis in the cannabis plant nutrients sector is influenced by various factors. Product efficacy and consistency are paramount, as cannabis cultivators seek reliable nutrient solutions that deliver consistent yields and quality. Brand reputation, especially in terms of reliability and trustworthiness, plays a crucial role as well. Price competitiveness, distribution networks, and customer support also contribute significantly to market share, as cultivators often prefer suppliers that offer a holistic package of value-added services.

New and emerging companies are entering the cannabis plant nutrients market to capitalize on the booming cannabis industry. Start-ups such as NutriGreen Innovations and BloomTech Solutions are introducing novel formulations, often incorporating proprietary blends and advanced technologies to enhance nutrient absorption by cannabis plants. These companies are positioning themselves as alternatives to traditional nutrient suppliers, targeting specific segments of the market with innovative and specialized offerings.

Industry news and updates are instrumental in shaping the competitive scenario in the cannabis plant nutrients market. Regulatory changes, scientific breakthroughs, and market trends influence the strategies adopted by key players. For example, recent studies highlighting the impact of specific nutrient formulations on cannabinoid profiles in cannabis plants have prompted companies to adjust their product offerings to cater to cultivators seeking particular chemical compositions in their yields.

Investment trends in the cannabis plant nutrients market reflect the industry's growth potential. Investors are keenly watching companies that demonstrate innovation in product development and those with a strong market presence. Funding rounds for nutrient solution providers have seen an uptick, indicating investor confidence in the continued expansion of the cannabis cultivation sector. This influx of capital enables companies to invest in research and development, expand production capacity, and enhance their marketing efforts.

The overall competitive scenario in the cannabis plant nutrients market is characterized by intense rivalry among key players, each striving to capture a larger market share. Price competition is common, with companies seeking to offer cost-effective solutions without compromising on quality. Building strong relationships with cannabis cultivators and expanding distribution channels, particularly in regions where cannabis cultivation is legal, are critical components of the competitive strategy.

Recent developments in 2023 have shaped the cannabis plant nutrients market in several ways. Notably, there has been an increased emphasis on precision agriculture and data-driven cultivation practices. Companies are integrating smart technologies into their nutrient solutions, providing cultivators with real-time monitoring and control capabilities. This trend aligns with the broader adoption of technology in agriculture, enhancing efficiency and yield optimization in cannabis cultivation.

Moreover, there is a growing awareness of sustainable cultivation practices, and nutrient solution providers are actively incorporating environmentally friendly formulations. With cannabis consumers expressing concern about the environmental impact of cultivation, companies are responding by developing nutrient solutions that minimize resource usage and reduce the overall ecological footprint of cannabis production.

- Beta

Beta feature