Emerging Trends in Sustainable Agriculture

Emerging trends in sustainable agriculture are influencing the cannabis plant-nutrients market, as growers seek environmentally friendly solutions. The shift towards sustainability is prompting the development of biodegradable and eco-friendly nutrient products. In 2025, it is anticipated that sustainable nutrient solutions will capture approximately 25% of the market share, as consumers and growers alike prioritize environmental responsibility. This trend not only aligns with broader agricultural practices but also enhances the reputation of cannabis cultivation. The cannabis plant-nutrients market is thus adapting to these changes, fostering innovation in sustainable nutrient formulations that meet the demands of a conscientious consumer base.

Regulatory Support for Cannabis Cultivation

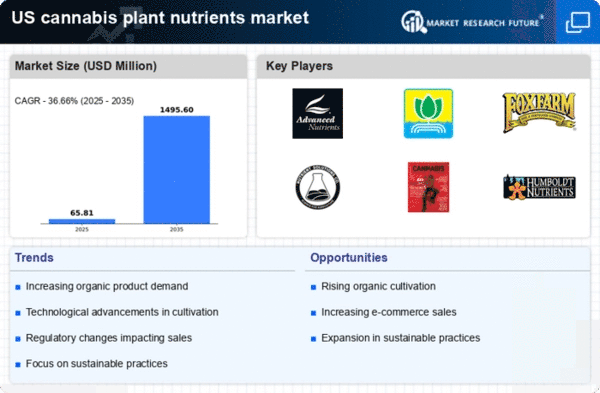

The cannabis plant-nutrients market benefits from increasing regulatory support for cannabis cultivation across various states. As more states legalize cannabis for both medicinal and recreational use, the demand for high-quality nutrients rises. In 2025, the market is projected to grow by approximately 15% annually, driven by the need for optimized growth conditions. This regulatory environment encourages growers to invest in specialized nutrients, enhancing crop yield and quality. Furthermore, state-level regulations often mandate the use of specific nutrient formulations, creating a niche market for compliant products. The cannabis plant-nutrients market is thus positioned to thrive as legal frameworks evolve, fostering a more robust cultivation ecosystem.

Increased Investment in Cannabis Cultivation

The cannabis plant-nutrients market is experiencing a surge in investment as more investors recognize the profitability of cannabis cultivation. This influx of capital is leading to the establishment of new cultivation facilities, which in turn drives demand for high-quality nutrients. In 2025, the market is projected to reach a valuation of $1 billion, reflecting the growing interest in cannabis as a lucrative agricultural sector. Investors are increasingly focused on supporting operations that utilize advanced nutrient solutions, which are believed to yield higher returns. Consequently, the cannabis plant-nutrients market is poised for substantial growth, fueled by this wave of investment.

Rising Consumer Awareness of Nutrient Quality

Consumer awareness regarding the quality of nutrients used in cannabis cultivation is on the rise, significantly impacting the cannabis plant-nutrients market. Growers are increasingly educated about the effects of nutrient quality on plant health and yield. This trend is reflected in the growing preference for organic and sustainably sourced nutrients, which are perceived to enhance the quality of the final product. In 2025, it is estimated that organic nutrients will account for over 30% of the market share, as consumers demand transparency and quality assurance. The cannabis plant-nutrients market is thus adapting to these consumer preferences, leading to innovations in nutrient formulations that prioritize health and sustainability.

Technological Advancements in Nutrient Formulation

Technological advancements in nutrient formulation are driving innovation within the cannabis plant-nutrients market. The development of precision agriculture techniques allows for tailored nutrient delivery systems that optimize plant growth. These technologies enable growers to monitor nutrient levels in real-time, ensuring that plants receive the right nutrients at the right time. As a result, the market is expected to see a surge in demand for advanced nutrient solutions, with a projected growth rate of 12% annually. The cannabis plant-nutrients market is thus evolving, as growers seek to leverage technology to enhance productivity and efficiency in their operations.