Market Trends

Key Emerging Trends in the Cannabis Plant Nutrients Market

The increasing recognition of the manifold benefits associated with cannabis has led to its legalization in several countries. There is substantial evidence supporting the legitimate medical applications of cannabinoids, spanning indications such as alleviating nausea and vomiting linked to chemotherapy, managing spasticity in multiple sclerosis, addressing HIV/AIDS cachexia, and mitigating neuropathic pain. A pivotal moment in the United States unfolded on June 28, 2018, when the Agriculture Improvement Act of 2018, commonly referred to as the Farm Bill, was officially passed by the US Senate. This legislative milestone brought about a reclassification of hemp for commercial utilization and removed hemp-derived CBD from the controlled substance list. Significantly, it conferred regulatory authority for hemp production to both states and the federal government, marking a paradigm shift in the treatment of hemp-related activities.

In the wake of the 2018 Farm Bill, the Agricultural Marketing Service (AMS) was designated as the primary agency within the United States Department of Agriculture (USDA) to oversee the newly established USDA Hemp Production Program. This transformative legislation dictated that hemp, once considered an illicit substance under the purview of the Justice Department, would now be managed as a legitimate crop by the Department of Agriculture. This change reflected a broader acknowledgment of the economic and industrial potential of hemp, particularly in the form of CBD-derived products.

Further underscoring the momentum towards cannabis normalization, the Ohio Senate took a decisive step on March 28, 2019, by unanimously passing Senate Bill-57. This legislation empowered farmers in Ohio to cultivate industrial hemp under a three-year license granted by the Ohio Department of Agriculture. The bill also introduced licensing requirements for cannabis processors, mandated testing of hemp products, and addressed the incorporation of cannabis products into consumables like food, beverages, and cosmetics. This multifaceted approach not only facilitates hemp cultivation but also ensures a regulated and safe entry of cannabis derivatives into various consumer products.

In Europe, the production of cannabis is legal in several countries, albeit with certain constraints on usage. Notably, the Czech Republic legalized medical cannabis in 2013, albeit with a limitation of 180 grams of dry matter per month. The regulatory landscape for cannabis across Europe is diverse, with individual countries establishing specific rules and restrictions. According to EU law, CBD products are constrained to containing no more than 0.2% tetrahydrocannabinol (THC), highlighting the stringent regulatory framework within the European Union.

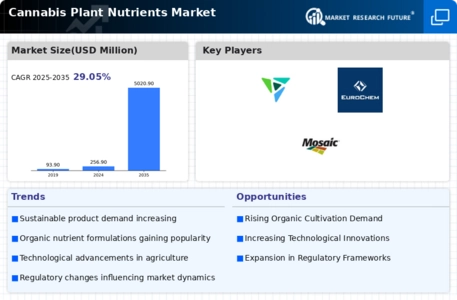

Considering the current global scenario, it is evident that the legalization of cannabis production and associated products in various countries is poised to catalyze the growth of the global cannabis plant nutrients market. The legislative strides made in different regions not only reflect evolving societal attitudes toward cannabis but also present significant opportunities for the industry stakeholders during the review period. The changing legal landscape, especially with the recognition of hemp as a legitimate crop, underscores the potential for substantial growth in the cannabis market, aligning with the increasing acceptance and understanding of its diverse applications.

Leave a Comment