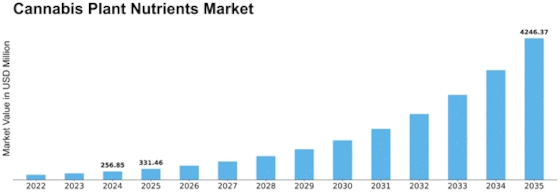

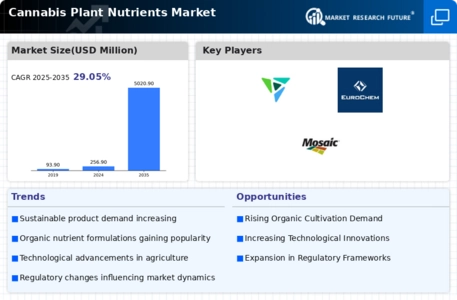

Cannabis Plant Nutrients Size

Cannabis Plant Nutrients Market Growth Projections and Opportunities

In numerous Asian countries, cannabis and its derivatives remain prohibited, constituting illegal substances. However, there is a noticeable transformation occurring in the legal landscape of certain countries in the region. Despite facing challenges rooted in both legal frameworks and cultural norms, Asia is emerging as a potential market for cannabis-related products. A noteworthy instance of this shift is observed in Thailand, where the Public Health Ministry took a groundbreaking step in November 2018. This initiative involved reclassifying cannabis and altering its status from a completely prohibited item. The move came through an amendment to the 1979 Narcotics Act, as Thailand's military junta-appointed parliament voted to legalize cannabis for medicinal and research purposes.

Similarly, South Korea has undergone a legal transformation pertaining to cannabis. In November 2018, the National Assembly in South Korea approved an amendment to the Narcotics Control Act. This amendment marked a significant development, allowing for the production of marijuana specifically for medical applications. This legislative shift reflects a growing recognition of the potential medicinal benefits of cannabis and a departure from the strict prohibitionist stance.

While Japan maintains a strict stance against the use of cannabis, there are noteworthy developments in the realm of research. Although the use of cannabis is illegal, the country has embarked on cannabinoid research initiatives. Approximately 40 farmers have been granted licenses to cultivate a low-THC strain of cannabis known as Tochigi Shiro. This illustrates a nuanced approach where Japan is exploring the potential benefits of cannabis in a controlled manner, primarily for research purposes.

These progressive initiatives in Asian countries indicate a notable shift in favor of cannabis production. The changes in legislation and regulations suggest a growing acknowledgment of the potential benefits of cannabis, particularly in the medical and research domains. As a result, these shifts are expected to create lucrative opportunities for market players in the cannabis industry in the years to come.

The cannabis and its derivatives remain illegal in most Asian countries, there is a visible evolution in the legal landscape in certain nations. Thailand's reclassification of cannabis and its legalization for medicinal and research purposes, along with South Korea's approval for marijuana production for medical use, exemplify this shift. Even in Japan, where cannabis use is illegal, the focus is on research, with licenses granted for cultivating specific low-THC strains. These legislative changes and research initiatives signify a growing acceptance and exploration of cannabis's potential benefits, creating promising opportunities for market players in the evolving cannabis landscape in Asia.

Leave a Comment