Market Analysis

In-depth Analysis of Captive Power Generation Market Industry Landscape

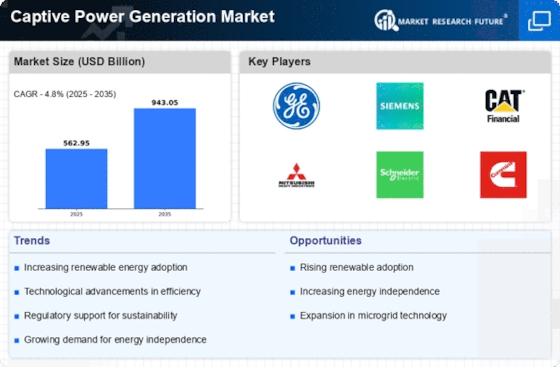

The growth dynamics and prospects of Captive Power Generation market are shaped by various market forces influencing it. Amongst them is the need for reliable uninterrupted supply by manufacturing and commercial establishments. The term refers to production for self-consumption meaning that businesses can control their own source which reduces dependence on grid connection. Manufacturing facilities such as data centers require constant electricity supply thus, they prefer generating their own electricity so as not be tempted by the national grid. The market dynamics of captively generated electric utilities feature advanced technical designs among other factors including distributed resource solutions in electric utilities. There is continuous innovation in generator designs, combined power plants and renewable energy products that help create efficient and eco-friendly captive power systems. As industries are looking for cost-effective and environmentally friendly energy solutions, manufacturers invest in research and development to come up with advanced generation technologies. Similarly, regulatory frameworks and policies shape the Captive Power Generation market. Governments around the world introduce measures to encourage industry into captive power generation for the purposes of increasing energy security, minimizing transmission losses related to energy supply as well as fostering cleaner sources of electricity. Their support by policies has led to increased uptake of on-site power plants across major sectors." Various economic aspects such as grid electricity cost, influence Captive Power Generation Market. When they evaluate the installation of captive power plants in industries, the viability of the projects is anchored on the prevailing prices of electric power and general state of economy for that region. Escalating costs of grid electricity may lead to a situation where industrial plants consider this method as an alternative that can help them manage their operational costs more effectively and remain competitive. Although during economic recessions, new captive generation projects may slow down, many businesses still view onsite power generation as a long-term cost-saving benefit. Captive Power Generation’s market dynamics are influenced by environmental considerations and growing emphasis on sustainability. Among their captive power generation strategies being adopted by companies include renewable-energy options; cogeneration; and adoption of other eco-friendly technologies. The urge to reduce carbon footprints and comply with environmental regulations makes firms look into cleaner forms of power generation which can be sustained in future hence embedding renewable energy sources into captive systems.

Leave a Comment