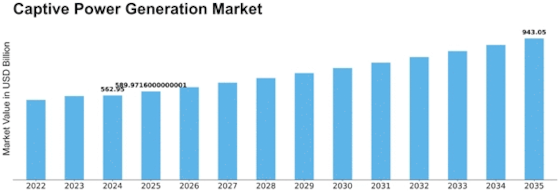

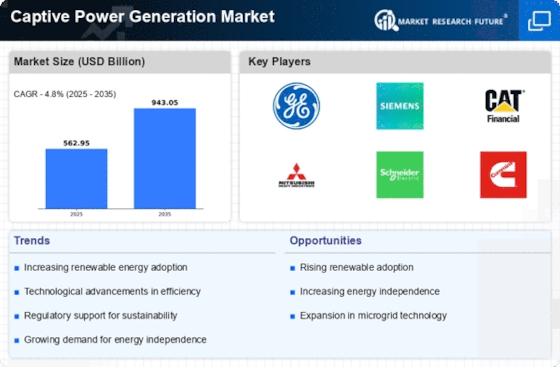

Captive Power Generation Size

Captive Power Generation Market Growth Projections and Opportunities

The captive power generation market is experiencing dynamic shifts influenced by factors like energy autarky, industrial growth among others as well as the need for reliable power supply. One of the key drivers shaping the market dynamics currently is companies and large commercial establishments striving to be self-sustaining in terms of energy. Captive power generation refers to electricity production by businesses for their own use thereby giving them control of their power supply and reducing reliance on external sources. This self-reliance is especially attractive to high-energy demand industries that ensure a steady uninterrupted flow of electric power. Increasing need for energy security has resulted to rapid adoption of captive power generation hence influencing the market dynamics positively. Industrial growth and expansion of manufacturing facilities are major contributors towards evolving dynamics in captive power generation market. As industries grow, so does their demand for consistent and cost-effective electricity supply. In those regions where grid infrastructure remains unreliable, captive power plants enable industries to effectively meet their energy requirements. The flexibility and reliability offered by captive power generation systems contribute to the market dynamics whereby they address the energy needs of expanding industries thus encouraging growth within the sector.

Government policies and regulatory frameworks related to energy security and sustainability play a pivotal role in shaping market dynamics of captive power generation system. There are various incentives, tax benefits as well as streamlined regulatory processes through which many governments encourage industrial investment into these plants (Captive Power Plants). These supportive policies create an environment conducive to development of such projects thereby driving investments in this sector hence influencing market dynamics (Captive Power Generation).

The evolving focus on sustainability and environmental responsibility affects how markets behave with regards to captive power generation today. Now organizations are exploring cleaner sources that can sustainably fuel their operations supporting global efforts targeted at mitigating carbon emissions. In terms of the green alternatives, renewable energy technologies like solar and wind are being integrated into captive power generation systems as a way of changing the market dynamics. The trend towards cleaner energy sources in captive power plants demonstrates how corporate social responsibility and sustainability goals shape the landscape of energy.

Leave a Comment