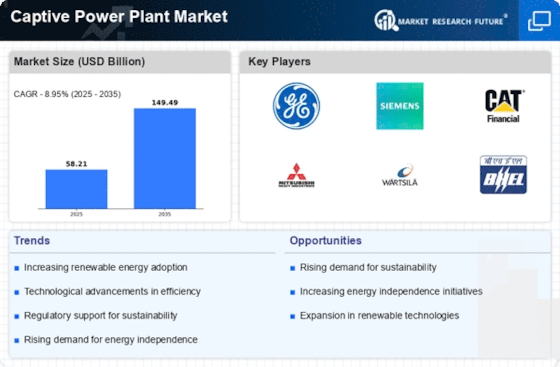

Rising Energy Demand

The Captive Power Plant Market is experiencing a notable surge in energy demand, driven by industrial growth and urbanization. As economies expand, the need for reliable and uninterrupted power supply becomes paramount. Industries such as manufacturing, mining, and data centers are increasingly relying on captive power plants to meet their energy needs. According to recent data, energy consumption in industrial sectors is projected to grow by approximately 3.5% annually, further emphasizing the necessity for captive power solutions. This trend indicates a robust market potential for captive power plants, as businesses seek to mitigate risks associated with energy shortages and price volatility. Consequently, the Captive Power Plant Market is likely to witness significant investments aimed at enhancing capacity and efficiency.

Technological Innovations

Technological advancements are reshaping the Captive Power Plant Market, enabling more efficient and sustainable energy generation. Innovations in energy management systems, such as smart grids and advanced monitoring technologies, are enhancing the operational efficiency of captive power plants. These technologies facilitate real-time data analysis, allowing for better decision-making and resource allocation. Moreover, the integration of renewable energy sources, such as solar and wind, into captive power systems is becoming increasingly feasible. This shift not only reduces carbon footprints but also aligns with global sustainability goals. As a result, the Captive Power Plant Market is likely to see a rise in demand for technologically advanced solutions that promote both efficiency and environmental responsibility.

Cost Efficiency and Energy Security

Cost efficiency remains a critical driver for the Captive Power Plant Market. Companies are increasingly recognizing the financial benefits of generating their own power, which can lead to substantial savings on energy costs. By utilizing captive power plants, businesses can avoid fluctuating grid prices and reduce dependency on external energy suppliers. Recent analyses suggest that organizations can save up to 20% on energy expenses by implementing captive power solutions. Furthermore, energy security is a growing concern, as disruptions in supply chains can lead to operational inefficiencies. The Captive Power Plant Market thus presents a viable solution for companies aiming to enhance their energy independence while simultaneously optimizing costs.

Regulatory Framework and Incentives

The regulatory landscape plays a pivotal role in shaping the Captive Power Plant Market. Governments are increasingly implementing policies and incentives to promote the use of captive power plants, particularly those that utilize renewable energy sources. These regulations often include tax benefits, subsidies, and streamlined permitting processes, which can significantly lower the barriers to entry for businesses. For instance, certain regions have introduced feed-in tariffs that guarantee fixed payments for energy generated from renewable sources. Such supportive measures are likely to encourage more companies to invest in captive power solutions, thereby expanding the market. The Captive Power Plant Market stands to benefit from these favorable regulatory conditions, which aim to enhance energy security and sustainability.

Environmental Sustainability Initiatives

Environmental sustainability is becoming a crucial driver for the Captive Power Plant Market. As awareness of climate change and environmental degradation grows, businesses are increasingly seeking ways to reduce their carbon footprints. Captive power plants, particularly those that incorporate renewable energy technologies, offer a viable solution for companies aiming to achieve sustainability goals. Recent studies indicate that organizations utilizing renewable captive power can reduce greenhouse gas emissions by up to 50%. This shift towards greener energy sources not only aligns with corporate social responsibility initiatives but also meets the expectations of environmentally conscious consumers. Consequently, the Captive Power Plant Market is likely to see a rise in demand for sustainable energy solutions as businesses strive to enhance their environmental credentials.