Market Share

Captive Power Generation Market Share Analysis

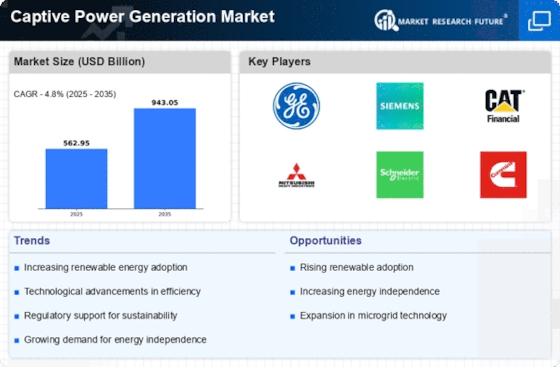

"The Captive Power Generation market is undergoing notable trends influenced by the changing dynamics of the energy sector and evolving industrial requirements. One notable trend is that more industries are adopting captive power generation to ensure they have secure sources of electricity other than depending entirely on the national grids. As businesses demand uninterrupted operation of their activities when electricity is not available from utilities; investments in captive plants like diesel generators, gas turbines or cogeneration units become strategic decisions. This shift reflects increased awareness among industries about grid disturbances with regards to ensuring continued uninterrupted power supply for critical processes. Another significant development in captive power generation market is incorporation of renewable sources within it. To achieve green objectives and lower carbon footprints, several firms have started incorporating solar, wind or biomass based plants into their own independent facilities. This supports wider industry trend toward greener alternatives in energy supplies. Hybrid captive systems combining conventional with non-conventional sources are becoming popular due to desire by firms minimize their environmental impacts while optimizing energy costs.

Moreover technological advancements dictate where it can be heading next., Technological advances influence how markets change in response to new products being introduced into them.Capabilities such as AI software systems create efficiency when used together with digital surveillance programs which assist device control operators; this not only improves data management but also allows for improved decision making thereby reducing equipment downtime. Thus, the use of these tools clearly reflects an ongoing digitalization shift in the energy sector that is driven by the necessity for exploiting technology to improve operations.

Energy efficiency and cost optimization are market trends that dominate the captive power generation industry. Industries have increasingly taken up combined heat and power (CHP) or cogeneration systems that use waste heat from electricity generation for industrial processes or heating. These systems enhance overall energy performance, reduce fuel consumption and save money. This wave resonates with twin objectives of economic viability improvement and environmental impact minimisation.

Leave a Comment