Technological Advancements

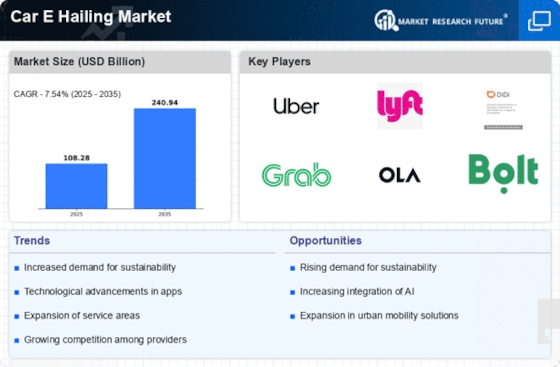

Technological advancements play a pivotal role in shaping the Car E Hailing Market. The integration of mobile applications, GPS technology, and real-time data analytics has revolutionized how consumers access transportation services. With the proliferation of smartphones, users can easily request rides, track their drivers, and make cashless payments. Furthermore, the rise of artificial intelligence and machine learning is enhancing the efficiency of ride-matching algorithms, optimizing routes, and improving customer experiences. As of 2025, it is estimated that the e-hailing market will reach a valuation of approximately 120 billion dollars, underscoring the impact of technology on the Car E Hailing Market.

Changing Consumer Preferences

Changing consumer preferences are significantly influencing the Car E Hailing Market. As individuals increasingly prioritize convenience, flexibility, and cost-effectiveness, e-hailing services are becoming the preferred mode of transportation. The shift towards on-demand services reflects a broader trend in consumer behavior, where traditional ownership models are being challenged. Surveys indicate that a substantial percentage of millennials and Gen Z consumers favor ride-hailing over car ownership, viewing it as a more sustainable and economical option. This evolving mindset is likely to propel the Car E Hailing Market forward, as companies adapt their offerings to meet the demands of a more discerning customer base.

Regulatory Support and Frameworks

Regulatory support and frameworks are crucial for the growth of the Car E Hailing Market. Governments are recognizing the potential of e-hailing services to alleviate traffic congestion and improve urban mobility. As a result, many regions are implementing favorable regulations that facilitate the operation of e-hailing platforms. This includes licensing frameworks, safety standards, and insurance requirements that ensure consumer protection while promoting innovation. The establishment of clear regulatory guidelines is likely to foster a more stable environment for e-hailing companies, encouraging investment and expansion within the Car E Hailing Market.

Urbanization and Population Growth

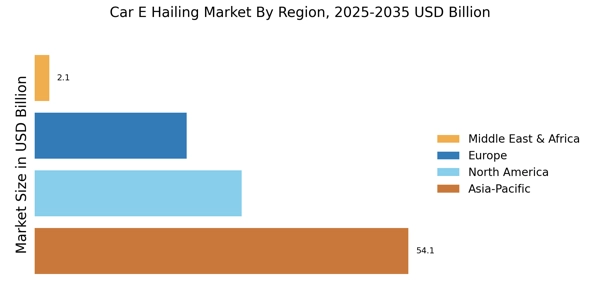

The Car E Hailing Market is experiencing a surge due to rapid urbanization and population growth. As more individuals migrate to urban areas, the demand for convenient transportation options increases. In densely populated cities, traditional public transport may not suffice, leading to a preference for e-hailing services. According to recent data, urban areas are projected to house over 68% of the world's population by 2050, which could significantly boost the Car E Hailing Market. This trend suggests that as cities expand, the need for efficient and flexible transportation solutions will likely drive the growth of e-hailing services, making them an integral part of urban mobility solutions.

Environmental Concerns and Sustainability

Environmental concerns are driving the Car E Hailing Market towards more sustainable practices. As awareness of climate change and pollution grows, consumers are increasingly seeking eco-friendly transportation options. E-hailing companies are responding by incorporating electric vehicles into their fleets and promoting carpooling services to reduce carbon footprints. Data suggests that the adoption of electric vehicles in the e-hailing sector could lead to a significant reduction in greenhouse gas emissions. This shift not only aligns with global sustainability goals but also appeals to environmentally conscious consumers, thereby enhancing the attractiveness of the Car E Hailing Market.

.png)