Regulatory Compliance Pressure

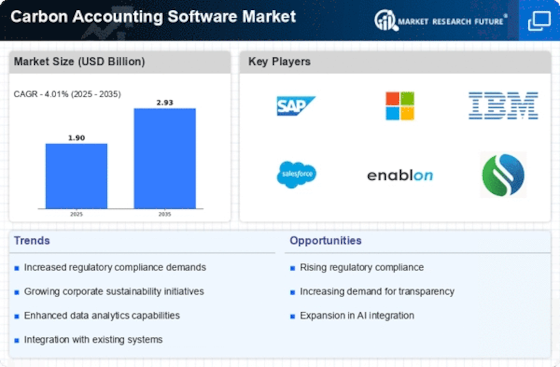

The increasing pressure from regulatory bodies to adhere to environmental standards is a primary driver for the Carbon Accounting Software Market. Governments worldwide are implementing stringent regulations aimed at reducing carbon emissions. For instance, the European Union's Green Deal mandates significant reductions in greenhouse gas emissions by 2030. This regulatory landscape compels organizations to adopt carbon accounting software to ensure compliance and avoid penalties. As a result, the demand for such software is expected to rise, with the market projected to grow at a compound annual growth rate of approximately 20% over the next five years. Companies are increasingly recognizing the necessity of integrating these solutions into their operations to maintain compliance and enhance their sustainability profiles.

Corporate Sustainability Initiatives

The growing emphasis on corporate sustainability initiatives is significantly influencing the Carbon Accounting Software Market. Organizations are increasingly adopting sustainability as a core business strategy, driven by consumer demand for environmentally responsible practices. A recent survey indicated that over 70% of consumers prefer brands that demonstrate a commitment to sustainability. Consequently, businesses are investing in carbon accounting software to track and report their carbon footprints accurately. This trend is likely to propel the market forward, as companies seek to enhance transparency and accountability in their sustainability efforts. The integration of carbon accounting software into corporate strategies not only aids in compliance but also fosters a positive brand image, which is becoming increasingly vital in today's market.

Investor and Stakeholder Expectations

Investor and stakeholder expectations are increasingly driving the Carbon Accounting Software Market. Investors are placing greater emphasis on environmental, social, and governance (ESG) criteria when making investment decisions. A report indicates that companies with strong sustainability practices tend to outperform their peers in the long run. As a result, organizations are compelled to adopt carbon accounting software to provide transparent and reliable data on their carbon emissions. This shift is not only about compliance but also about meeting the expectations of stakeholders who demand accountability and sustainability. The growing trend of sustainable investing is likely to further fuel the demand for carbon accounting software, as companies seek to align their operations with investor values.

Competitive Advantage through Carbon Management

The pursuit of competitive advantage is a significant driver for the Carbon Accounting Software Market. Organizations are increasingly recognizing that effective carbon management can differentiate them in the marketplace. By adopting carbon accounting software, companies can gain insights into their carbon emissions and identify opportunities for reduction. This proactive approach not only enhances operational efficiency but also positions companies favorably in the eyes of consumers and investors. The market is witnessing a shift where businesses that prioritize sustainability are likely to outperform their competitors. As such, the demand for carbon accounting software is expected to grow, as organizations seek to leverage these tools to enhance their market positioning and drive long-term success.

Technological Advancements in Software Solutions

Technological advancements are playing a crucial role in shaping the Carbon Accounting Software Market. Innovations such as artificial intelligence and machine learning are enhancing the capabilities of carbon accounting software, allowing for more accurate data collection and analysis. These technologies enable organizations to automate their carbon accounting processes, reducing manual errors and improving efficiency. The market is witnessing a surge in demand for software solutions that offer real-time data analytics and predictive modeling. As organizations strive to optimize their carbon management strategies, the adoption of advanced software solutions is expected to increase. This trend suggests a robust growth trajectory for the market, with estimates indicating a potential market size exceeding $1 billion by 2028.