Market Analysis

In-depth Analysis of Cardiovascular Needle Market Industry Landscape

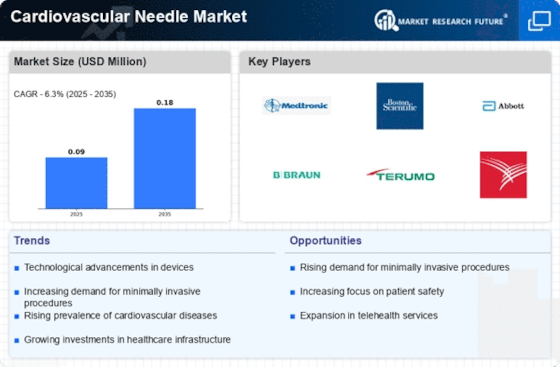

The cardiovascular needle market is vital to the medical goods industry. This is mainly because cardiovascular problems are spreading worldwide. Cardiovascular needles are needed for open-heart operations, circulatory therapies, and heart repairs. Market growth is driven by increased cardiovascular disease rates. Poor diet, inactivity, and aging increase heart disease rates. This makes cardiovascular needles more common in medical treatments.

Technology has changed the circulatory needle industry. Modern materials and procedures make cardiovascular needles more precise and effective. Safe materials, high-tech coatings, and improved needle designs improve patient outcomes. Patients seek speedier healing and fewer side effects following surgery, therefore doctors are using somewhat invasive therapies. Circulatory gadgets for minimally invasive therapies are in high demand. This demand increase matches what the medical industry is observing. The rise of healthcare facilities worldwide has made modern medicine more accessible. This increased circulatory needle usage. The company is growing because emerging nations are doing more cardiac surgery and treatments. Health authorities worldwide regulate the circulation needle industry by tight criteria. Market participants must follow these requirements for safe and effective products. This demands rigorous testing and quality control. Multiple large firms compete for market domination, making it tricky. Mergers and acquisitions are a major trend that helps firms improve their products and expand globally. Business expansion is hindered by healthcare payment issues and expense caps. Heart medications are pricey and need particular gear. This might restrict market expansion, particularly in poor healthcare areas. Research and development are affecting arterial needles. Manufacturers are investing in more specialized and efficient suturing instruments to reduce discomfort, speed up the process, and improve outcomes. In arterial needle sales, patient safety is paramount. Needle-related tissue damage and infections demonstrate the need to constantly improve needle design and manufacture. Due to the growing importance of sustainability, the cardiovascular needle market is adopting greener goods and manufacturing processes. This shows how the healthcare industry is working to reduce its environmental impact.

Leave a Comment