Market Analysis

In-depth Analysis of Carrier Wi-Fi Equipment Market Industry Landscape

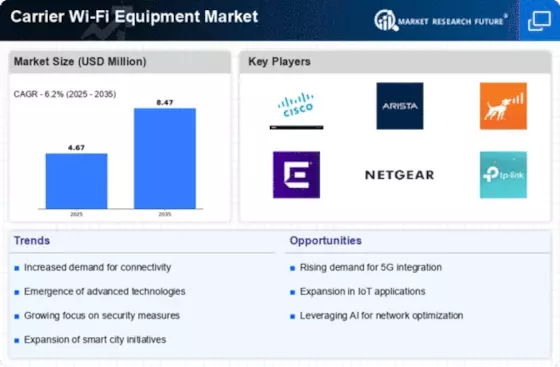

The carrier Wi-Fi equipment market is a dynamic and quickly developing area within the media communications industry. The market elements of carrier Wi-Fi equipment are affected by different variables, including innovative progressions, expanding interest for high velocity web, and the multiplication of wireless gadgets.

One of the main driving forces shaping market dynamics is increased demand for continuous and high speed availability. The advent of smartphones, tablets and other wireless devices drove the customers as well as companies to have reliable and faster Wi-Fi connections. The Haiti flood popular has been the cause of carriers’ investment on modern Wi-Fi equipment to address their client issues.

In addition, the increasing number of novel innovations such as 5G and Web of Things (IoT) greatly influence carrier Wi-Fi equipment market. While carriers focus on delivering 5G services and expanding IoT capabilities, the need for powerful and effective Wi-Fi hardware to supplement these technologies has skyrocketed. This has led to a broader focus on developing carrier-grade Wi-Fi solutions that seamlessly complement 5G services and support the increasing number of IoT devices.

Furthermore, carrier Wi-Fi equipment’s market components are influenced by the competitive environment. With further players entering the market, rivalry raises and this leads to innovations in equipment design; features and pricing. This strong climate has compelled merchants to relentlessly update their items, boost execution and stand apart through unique advantages.

In addition, the administrative climate and norms play a critical role in defining carrier Wi-Fi equipment market elements. Compliance with administrative requirements including range designation and security standards directly influence Wi-Fi device development and deployment. Sellers should also be aware of newly developed guidelines and ensure that their products match the industry standards and meet the demands of regulatory agencies.

Moreover, market factors are also influenced by the move towards virtualization and cloud-based solutions. Carriers are increasingly adopting virtualized Wi-Fi architecture in order to increase their flexibility, agility and cost effectiveness. This shift towards cloud-based Wi-Fi arrangements has reshaped the market elements, with sellers zeroing in on conveying programming driven, cloud-oversaw equipment that can be handily sent and overseen via carriers.

Leave a Comment