Top Industry Leaders in the Carrier Wi-Fi Equipment Market

Competitive Landscape: Carrier Wi-Fi Equipment Market

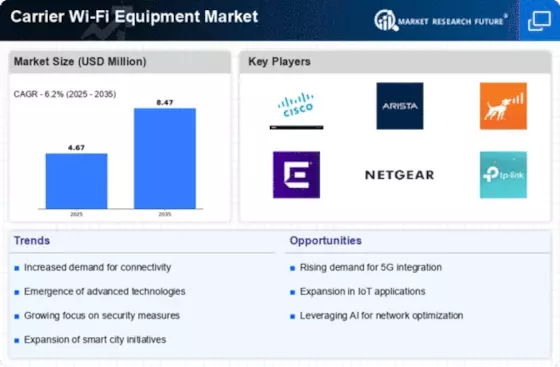

The Carrier Wi-Fi Equipment Market, poised for significant growth driven by increasing data traffic and offloading demands, presents a dynamic landscape brimming with established players and emerging contenders. Understanding the strategies adopted, key stakeholders, and investment trends is crucial for navigating this competitive terrain.

Key Players:

- Nokia Networks (Finland)

- Cisco Systems, Inc (U.S.)

- Ericsson (Sweden)

- Edgewater Wireless Systems, Inc (Canada)

- Aruba Networks (U.S.)

- Ruckus Wireless, Inc (U.S.)

- Huawei Technologies Co. Ltd. (China)

- Hewlett Packard Enterprise Development LP (U.S.)

- Aerohive Networks (U.S.)

- Brocade Communication Systems, Inc.

Strategies for Market Share Dominance:

- Technology Innovation: Leading players are aggressively investing in next-generation Wi-Fi 6 and 6E technologies, offering higher speeds, lower latency, and improved network efficiency. Additionally, advancements in security, artificial intelligence-powered network management, and seamless handoff between cellular and Wi-Fi networks are key focus areas.

- Strategic Partnerships and Acquisitions: Collaborations with cloud providers, content delivery networks, and system integrators are becoming commonplace to offer end-to-end solutions and optimize network performance. Acquisitions of smaller players with niche expertise or regional strengths are also observed to bolster portfolios and expand market reach.

- Market Diversification: Players are moving beyond traditional carrier deployments, targeting new verticals like public Wi-Fi in enterprises, airports, and stadiums. Expanding product offerings to cater to these diverse needs is driving market growth.

Factors for Market Share Analysis:

- Product Portfolio Breadth and Depth: The ability to offer a comprehensive range of equipment encompassing access points, controllers, software, and managed services plays a crucial role.

- Technological Prowess: Continuous innovation in Wi-Fi standards, network management capabilities, and security features differentiates leading players.

- Global Reach and Customer Service: Extensive presence across key markets and a robust customer support infrastructure are essential for attracting and retaining large carriers.

- Pricing and Deployment Flexibility: Cost-effective solutions, flexible deployment options (centralized vs. distributed), and financing models influence purchase decisions.

New and Emerging Companies:

- Small Cell and Open RAN Players: Companies like Airspan Networks and Parallel Wireless are entering the fray, offering Open RAN-based carrier Wi-Fi solutions aimed at disrupting the dominance of traditional vendors.

- Software-Defined Networking (SDN) Startups: Niche players like Mist Systems and Meraki are innovating in SDN-based Wi-Fi management platforms, simplifying deployments and offering greater network programmability.

Current Company Investment Trends:

- Focus on Wi-Fi 6 and 6E: Major players are ramping up research and development in these next-generation technologies, anticipating significant uptake in the near future.

- Cloud-Based Management Platforms: Investments in cloud-based software for centralized network management, analytics, and automation are on the rise.

- Security Enhancements: Cybersecurity is a top priority, with vendors focusing on developing advanced security features and threat detection capabilities.

- Partnerships and Ecosystem Building: Collaborations with technology providers, service integrators, and vertical specific solution developers are fostering a robust carrier Wi-Fi ecosystem.

Latest Company Updates:

Jan 12, 2024: This strategic partnership aims to provide carriers with a secure and scalable cloud platform for managing their Wi-Fi networks, leveraging Azure's AI and analytics capabilities.

Dec 20, 2023: This new product targets high-density deployments like stadiums and airports, promising significant speed improvements and reduced latency.

Jan 5, 2024: This tool uses machine learning to automatically adjust Wi-Fi settings for optimal performance, reducing network congestion and improving user experience.

Nov 15, 2023: This collaboration demonstrates the growing importance of seamless integration between cellular and Wi-Fi networks for efficient data management.

Dec 1, 2023: This projected growth is driven by factors like increasing data traffic, network offloading, and deployment in new verticals like smart cities and industrial IoT.