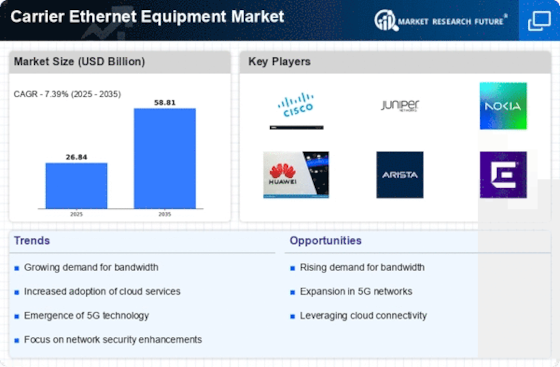

Adoption of 5G Technology

The advent of 5G technology is poised to significantly influence the Carrier Ethernet Equipment Market. With its promise of ultra-low latency and enhanced data transfer speeds, 5G is expected to create new opportunities for Ethernet service providers. The integration of Carrier Ethernet with 5G networks allows for seamless connectivity and improved service delivery. As telecommunications companies roll out 5G infrastructure, the demand for Carrier Ethernet solutions that can support these networks is likely to increase. Analysts suggest that the 5G rollout could lead to a market growth rate of approximately 20% annually, as businesses and consumers alike seek to leverage the benefits of next-generation connectivity.

Rising Demand for Bandwidth

The Carrier Ethernet Equipment Market is experiencing a notable surge in demand for bandwidth, driven by the proliferation of data-intensive applications and services. As organizations increasingly rely on cloud computing, video conferencing, and streaming services, the need for high-capacity Ethernet solutions becomes paramount. According to recent estimates, the global bandwidth consumption is projected to grow at a compound annual growth rate of over 25% in the coming years. This trend compels service providers to invest in advanced Carrier Ethernet equipment to meet customer expectations for speed and reliability. Consequently, the market is likely to witness a robust expansion as businesses seek to enhance their network capabilities to accommodate this escalating demand.

Emergence of IoT Applications

The proliferation of Internet of Things (IoT) applications is significantly impacting the Carrier Ethernet Equipment Market. As more devices become interconnected, the demand for reliable and scalable Ethernet solutions is increasing. IoT applications require robust network infrastructure to support real-time data transmission and processing. Consequently, service providers are investing in Carrier Ethernet equipment that can handle the unique challenges posed by IoT deployments. The market is expected to grow at a compound annual growth rate of 18%, driven by the need for efficient data management and connectivity in various sectors, including healthcare, manufacturing, and smart cities. This trend underscores the critical role of Carrier Ethernet in enabling the IoT ecosystem.

Increased Focus on Network Security

In an era where cyber threats are becoming increasingly sophisticated, the Carrier Ethernet Equipment Market is witnessing a heightened emphasis on network security. Organizations are prioritizing secure communication channels to protect sensitive data and maintain customer trust. As a result, Ethernet equipment manufacturers are integrating advanced security features into their products, such as encryption and intrusion detection systems. This trend is expected to drive market growth, as businesses recognize the importance of safeguarding their networks against potential breaches. The market for secure Carrier Ethernet solutions is projected to expand at a rate of 15% annually, reflecting the growing awareness of cybersecurity risks among enterprises.

Growing Need for Cost-Effective Solutions

Cost efficiency remains a pivotal driver in the Carrier Ethernet Equipment Market. As businesses strive to optimize their operational expenditures, there is a growing demand for cost-effective Ethernet solutions that do not compromise on performance. Service providers are increasingly offering competitive pricing models and flexible service plans to attract customers. This trend is likely to stimulate market growth, as organizations seek to balance their budgetary constraints with the need for high-quality connectivity. Analysts predict that the market for cost-effective Carrier Ethernet solutions will expand at a rate of 12% annually, reflecting the ongoing pursuit of value-driven networking options among enterprises.