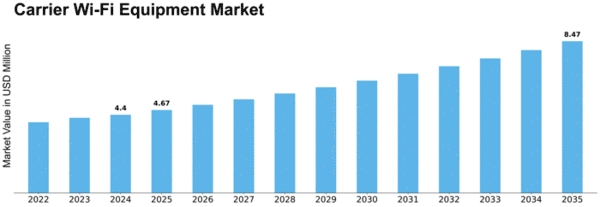

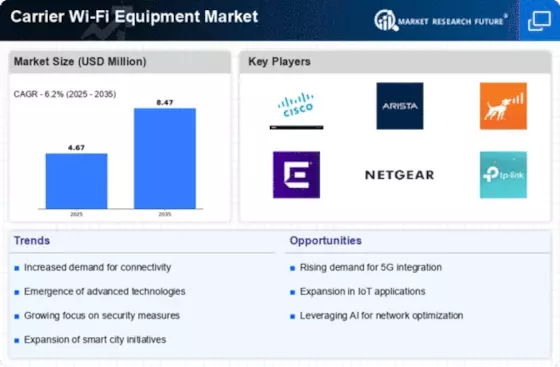

Carrier Wi Fi Equipment Size

Carrier Wi-Fi Equipment Market Growth Projections and Opportunities

The carrier Wi-Fi equipment market is impacted by a few market factors that shape its development and elements. Among the main market drivers is an increase in demand for high speed internet access. When cell phones, tablets and other similar devices are multiplied in the market consumers as well as business organizations seek for efficient Wi-Fi solutions. The trendy popular flood, which is pushing the carrier Wi-Fi equipment market to grow as telecom administrators and service providers are trying to solve issues of their clients.

Another fundamental market driver is the fast growth of smart city pilots and IoT (Internet of Things) solutions. With the urban areas and districts spending on smart infrastructure, carrier Wi-Fi equipment is increasingly required to support these projects. From communal Wi-Fi spaces of interest to smart transportation systems, carrier Wi-Fi hardware plays a significant role in the enabled network connectivity and communication within smart city ecosystems.

In addition, the development of carrier Wi-Fi gear advertise is influenced by continual advancements in wireless innovation standards. The introduction of Wi-Fi 6 (802.11ax) and the upcoming release of Wi -Fi 6 E standard provides significant opportunities for hardware vendors to offer world class, high end solutions that address growing needs toward increased data speeds with improved capacity limits as well as enhanced user experiences. The above is then seen through a steady dedication and technological advancements to remain competitive while fulfilling the upcoming needs of management personnel.

Market consolidation and dominant players also contribute to the shaping of carrier Wi-Fi equipment market. Consolidations, acquisitions and cooperation among equipment vendors, telecom operators and technology providers affect market dynamics hence price offering actions tend to influence product offerings distribution channels as well as competitive positioning. These enhancements in most cases ignite the development of incorporated arrangements and huge contributions that target a wider range of communal needs, thus impeding on its direction and competitive nature.

In addition, administrative strategies and guidelines play an important role in shaping the carrier Wi-Fi equipment market. Industry guidelines adherence, allocation of network assets and government initiatives for community and broadcast communications infrastructure directly impact the market’s development model. Adherence to administrative necessities and guidelines impacts item improvement, organization techniques, and market access, making it fundamental for industry partners to screen and adjust to developing administrative scenes.

Leave a Comment