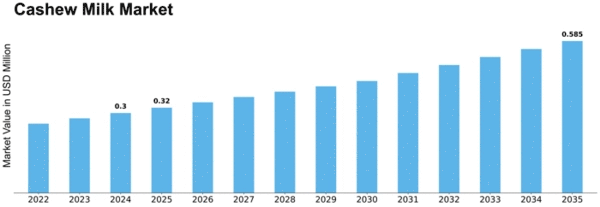

Cashew Milk Size

Cashew Milk Market Growth Projections and Opportunities

The Cashew Milk Market is influenced by a combination of factors that collectively shape its growth and dynamics. One of the primary drivers propelling this market is the increasing demand for plant-based milk alternatives. As consumers seek dairy-free options due to lactose intolerance, dietary preferences, or environmental concerns, plant-based milk alternatives, including cashew milk, have gained popularity. Cashew milk stands out for its creamy texture, mild flavor, and nutritional profile, making it an attractive choice for those looking to replace traditional dairy milk.

Economic factors play a significant role in shaping the Cashew Milk Market. Fluctuations in income levels, consumer spending patterns, and overall economic stability impact the affordability and consumption of plant-based milk alternatives, including cashew milk. Economic conditions influence purchasing decisions, with consumers opting for cost-effective yet high-quality alternatives that align with their dietary choices.

Consumer awareness of health and wellness contributes to the growth of the Cashew Milk Market. The perceived health benefits of plant-based diets, coupled with the nutritional content of cashew milk, appeal to health-conscious consumers. Cashew milk is often fortified with vitamins and minerals, providing a suitable alternative to dairy milk while meeting the dietary needs of those seeking plant-based options.

Technological advancements in food processing contribute to the expansion of the Cashew Milk Market. Innovations in extraction and processing technologies allow manufacturers to enhance the flavor, texture, and shelf life of cashew milk. Advanced processing methods also contribute to the development of various cashew milk-based products, such as flavored varieties, ready-to-drink options, and culinary applications.

Regulatory factors play a crucial role in shaping the Cashew Milk Market. Compliance with food safety, labeling, and quality standards is essential for cashew milk producers to ensure the safety and transparency of their products. As plant-based milk alternatives gain popularity, regulatory frameworks may evolve to address labeling standards and nutritional information for these products.

Sustainability considerations are gaining prominence in the Cashew Milk Market. As environmental awareness grows, consumers are seeking products with lower environmental impact. Cashew milk, like other plant-based alternatives, is often perceived as a more sustainable choice due to its lower carbon footprint compared to traditional dairy production. Manufacturers may emphasize sustainable sourcing practices and eco-friendly packaging to align with consumer preferences.

Market competition is a significant factor influencing the Cashew Milk Market. The presence of various players, including plant-based milk producers and dairy alternatives brands, fosters competition that drives innovation and product development. Companies strive to differentiate their cashew milk offerings through unique formulations, flavor varieties, and marketing strategies to gain a competitive edge in the growing plant-based milk market.

Global events, such as the COVID-19 pandemic, highlight the importance of supply chain resilience in the Cashew Milk Market. Disruptions in transportation, labor shortages, and changes in consumer behavior during such events can impact the production and distribution of cashew milk. The industry's ability to adapt to unforeseen challenges and maintain a stable supply chain is crucial for sustained growth.

Leave a Comment