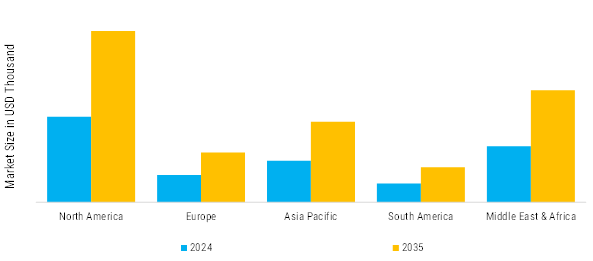

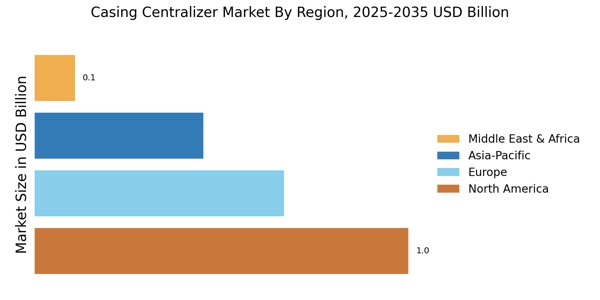

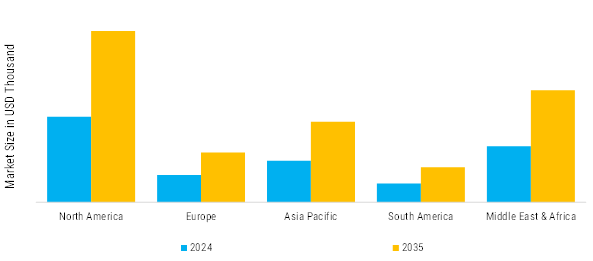

North America: Increased Casing Centralizer

North America stands as the largest and most mature market for casing centralizers, driven primarily by extensive oil and gas drilling activity, particularly in unconventional shale plays, and the region's technological leadership in horizontal drilling and completion techniques. The United States dominates regional demand through its vast shale oil and gas developments in basins such as the Permian, Eagle Ford, Bakken, and various gas shale plays, where high-intensity centralizer usage in long horizontal wells creates substantial volume demand. The region's market is characterized by sophisticated technical requirements, strong emphasis on operational efficiency and cementing quality, and rapid adoption of innovations in centralizer design and materials.

Europe: Emerging Casing Centralizer

Europe represents a mature but relatively smaller market for casing centralizers, characterized by declining conventional oil and gas production, limited unconventional resource development, offset by growing geothermal energy and carbon storage well construction. The North Sea offshore sector remains significant for centralizer demand despite declining drilling activity, with challenging deepwater conditions and stringent regulatory requirements driving specification of high-performance centralizers and emphasis on operational reliability. Onshore drilling in Europe is limited by environmental concerns, population density, and regulatory constraints, though countries like Romania, Poland, and parts of the United Kingdom maintain modest conventional production activity.

Asia-Pacific: Rapidly Growing Casing Centralizer

Asia Pacific emerges as the fastest-growing regional market for casing centralizers, driven by substantial oil and gas development activity, rapidly increasing energy demand, and expanding drilling programs across diverse countries with varying resource endowments and technical capabilities. China represents the largest country market in the region through its extensive onshore and offshore drilling activity, including conventional resources, tight oil and gas development, and the world's largest geothermal direct-use capacity. India demonstrates strong growth driven by domestic oil and gas development efforts, expanding offshore exploration, and increasing energy infrastructure development.

Middle East and Africa: Emerging Casing Centralizer

Middle East and Africa represent a strategically important region combining the world's most prolific conventional oil and gas resources with emerging geothermal potential and diverse market dynamics across vastly different countries and operating environments. The Middle East, particularly Saudi Arabia, United Arab Emirates, Kuwait, Iraq, and Qatar, generates steady centralizer demand from extensive drilling programs in conventional reservoirs, though vertical well predominance and favorable geology generally result in lower centralizer intensity compared to unconventional horizontal wells. The region's focus on maintaining and expanding production capacity from giant fields, combined with offshore developments and gas exploration initiatives, supports consistent demand with less cyclicality than other regions

South America: Rapidly Develop Casing Centralizer

South America presents a dynamic regional market with significant potential driven by substantial hydrocarbon resources, including offshore pre-salt developments, unconventional resources, and conventional production, though political and economic volatility creates market uncertainty. Brazil dominates regional demand through its world-class offshore pre-salt oil developments in the Santos and Campos basins, which require advanced centralizer technologies to address challenging deepwater conditions, high-pressure high-temperature environments, and critical cementing requirements for well integrity.