Advancements in Battery Technology

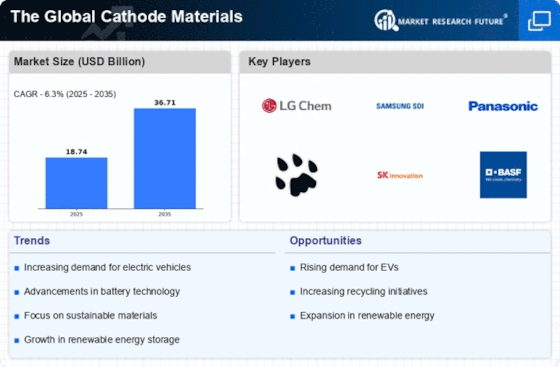

Technological advancements in battery chemistry are reshaping The Global Cathode Materials Industry. Innovations such as solid-state batteries and enhanced lithium-ion technologies are emerging, promising higher energy densities and improved safety. For instance, solid-state batteries could potentially offer energy densities exceeding 300 Wh/kg, which is a substantial improvement over conventional lithium-ion batteries. These advancements not only enhance battery performance but also drive the demand for specialized cathode materials that can support these new technologies. As manufacturers invest in research and development to optimize battery performance, the market for cathode materials is expected to expand, reflecting the industry's dynamic nature.

Rising Consumer Electronics Market

The expansion of the consumer electronics market is another significant driver for The Global Cathode Materials Industry. With the proliferation of smartphones, laptops, and other portable devices, the demand for high-capacity batteries is increasing. Lithium-ion batteries, which are widely used in consumer electronics, rely heavily on advanced cathode materials to enhance performance and longevity. In 2025, The Global Cathode Materials Market is expected to surpass 1 trillion USD, further fueling the demand for cathode materials. This growth not only supports the existing market but also encourages innovation in cathode material formulations to meet the evolving needs of consumers.

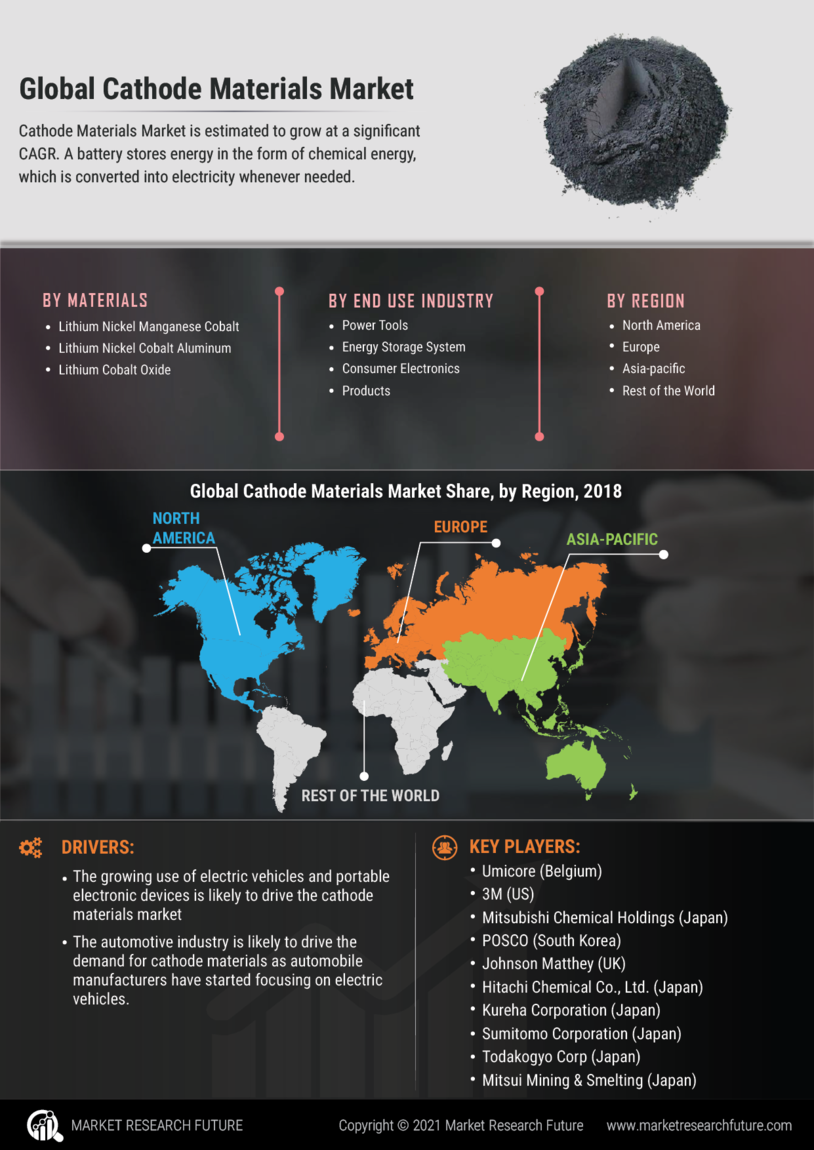

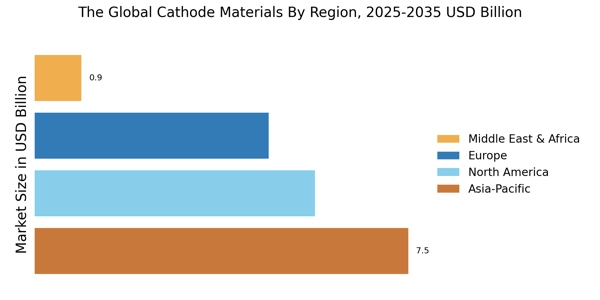

Growing Demand for Electric Vehicles

The rising demand for electric vehicles (EVs) is a primary driver for The Global Cathode Materials Industry. As consumers increasingly prioritize sustainability and energy efficiency, automakers are responding by expanding their EV offerings. In 2025, The Global Cathode Materials Market is projected to reach approximately 30 million units sold, significantly boosting the need for high-performance cathode materials. Lithium-ion batteries, which are integral to EVs, rely heavily on cathode materials such as lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP). This surge in EV production is likely to create a robust demand for cathode materials, thereby propelling market growth and innovation in the industry.

Increasing Energy Storage Applications

The growing need for energy storage solutions is a crucial driver for The Global Cathode Materials Industry. As renewable energy sources like solar and wind become more prevalent, the demand for efficient energy storage systems is rising. Cathode materials play a vital role in the performance of energy storage systems, particularly in large-scale applications such as grid storage. The Global Cathode Materials Market is projected to reach over 200 GWh by 2025, creating a substantial opportunity for cathode material suppliers. This trend indicates a shift towards integrating advanced cathode materials that can enhance the efficiency and longevity of energy storage systems, thereby driving market growth.

Regulatory Support for Clean Energy Initiatives

Regulatory frameworks promoting clean energy initiatives are significantly influencing The Global Cathode Materials Industry. Governments worldwide are implementing policies aimed at reducing carbon emissions and promoting renewable energy sources. For example, various countries have set ambitious targets for EV adoption, which in turn drives the demand for cathode materials essential for battery production. The European Union's Green Deal aims to make Europe climate-neutral by 2050, which includes substantial investments in battery production and technology. Such regulatory support not only fosters market growth but also encourages innovation in cathode materials, as manufacturers seek to comply with stringent environmental standards.