Increased Research Funding

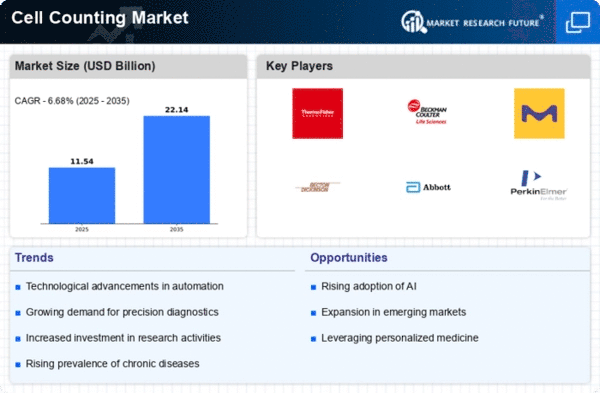

The Global Cell Counting Market Industry benefits from increased funding for research and development in life sciences. Government and private sector investments are directed towards advancing cellular biology, biotechnology, and pharmaceutical research. This influx of funding supports the development of innovative cell counting technologies and methodologies. For example, various government initiatives aim to enhance research capabilities in cellular analysis, which is likely to propel market growth. The anticipated compound annual growth rate of 8.52% from 2025 to 2035 suggests that the industry will continue to thrive as research efforts expand globally.

Technological Advancements

The Global Cell Counting Market Industry is experiencing rapid growth due to continuous technological advancements in cell counting techniques. Innovations such as automated cell counters and flow cytometry are enhancing accuracy and efficiency in cell analysis. For instance, the introduction of microfluidic devices allows for high-throughput cell counting, which is particularly beneficial in research and clinical settings. As these technologies evolve, they are expected to drive market expansion, contributing to an estimated market value of 8.62 USD Billion in 2024. The integration of artificial intelligence in cell counting processes further indicates a promising future for the industry.

Rising Demand in Healthcare

The Global Cell Counting Market Industry is significantly influenced by the rising demand for cell-based therapies and diagnostics in the healthcare sector. As the prevalence of chronic diseases increases, there is a growing need for precise cell counting methods to monitor treatment efficacy and disease progression. This trend is reflected in the projected market growth, with an expected value of 21.2 USD Billion by 2035. The healthcare industry's focus on personalized medicine and regenerative therapies further underscores the importance of accurate cell counting, thereby driving the demand for advanced cell counting technologies.

Growing Biopharmaceutical Sector

The Global Cell Counting Market Industry is positively impacted by the growth of the biopharmaceutical sector. As biopharmaceutical companies increasingly rely on cell-based assays for drug development and quality control, the demand for reliable cell counting solutions rises. The biopharmaceutical industry is projected to expand significantly, with a focus on monoclonal antibodies and cell therapies. This trend necessitates precise cell counting to ensure product quality and efficacy. Consequently, the market is expected to witness substantial growth, aligning with the overall increase in biopharmaceutical investments and innovations.

Emerging Markets and Global Expansion

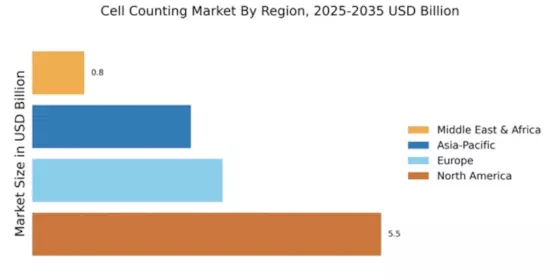

The Global Cell Counting Market Industry is poised for growth as emerging markets increasingly adopt advanced cell counting technologies. Countries in Asia-Pacific and Latin America are witnessing a surge in research activities and healthcare investments, leading to a higher demand for cell counting solutions. The expansion of healthcare infrastructure and rising awareness of cell-based diagnostics in these regions contribute to market growth. As global players seek to penetrate these emerging markets, the industry is likely to experience a significant boost, further enhancing its global footprint.