Regulatory Support and Frameworks

The Cell and Gene Therapy CDMO Market is positively impacted by evolving regulatory support and frameworks. Regulatory agencies are increasingly recognizing the potential of cell and gene therapies, leading to the establishment of more streamlined approval processes. This regulatory evolution is crucial for CDMOs, as it facilitates quicker market access for new therapies. In recent years, several countries have implemented expedited pathways for the approval of innovative treatments, which is expected to continue. As a result, CDMOs are likely to play a pivotal role in ensuring compliance with these regulations, thereby enhancing their value proposition to biopharmaceutical companies. The supportive regulatory environment not only encourages investment in the sector but also fosters innovation, ultimately benefiting patients in need of advanced therapies.

Expansion of Biopharmaceutical Companies

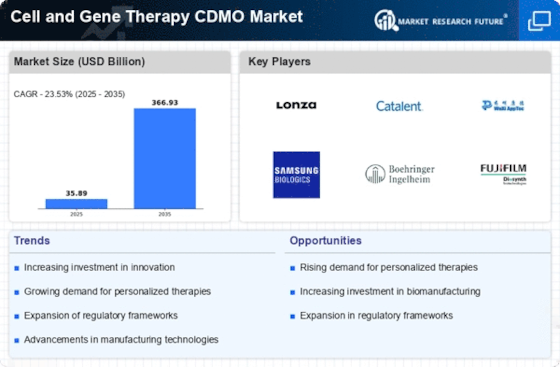

The Cell and Gene Therapy CDMO Market is witnessing a significant expansion of biopharmaceutical companies, which is a key driver of market growth. As these companies increasingly focus on developing innovative therapies, the demand for specialized manufacturing services provided by CDMOs is likely to rise. In recent years, the number of biopharmaceutical firms has increased, with many entering the cell and gene therapy space. This expansion is expected to continue, with estimates suggesting that the biopharmaceutical sector could grow at a compound annual growth rate of over 8% through the next decade. Consequently, CDMOs are becoming essential partners for these companies, offering expertise in complex manufacturing processes and regulatory compliance, thereby facilitating the timely delivery of new therapies to the market.

Advancements in Manufacturing Technologies

The Cell and Gene Therapy CDMO Market is significantly influenced by advancements in manufacturing technologies. Innovations such as automation, continuous manufacturing, and improved bioreactor designs are enhancing the efficiency and scalability of production processes. These technological improvements are crucial for meeting the increasing demand for cell and gene therapies, which often require complex and precise manufacturing techniques. In 2025, the market for advanced manufacturing technologies in biopharmaceuticals is expected to grow substantially, reflecting the industry's shift towards more efficient production methods. CDMOs that adopt these technologies are likely to gain a competitive edge, as they can offer faster turnaround times and reduced costs, ultimately benefiting their clients in the rapidly evolving therapeutic landscape.

Increasing Demand for Personalized Medicine

The Cell and Gene Therapy CDMO Market is experiencing a notable surge in demand for personalized medicine. This trend is driven by advancements in genetic research and the growing understanding of individual genetic profiles. As therapies become more tailored to specific patient needs, the role of contract development and manufacturing organizations (CDMOs) becomes increasingly critical. In 2025, the market for personalized medicine is projected to reach substantial figures, indicating a robust growth trajectory. CDMOs are positioned to support the development and production of these customized therapies, thereby enhancing their relevance in the healthcare landscape. This increasing demand not only reflects a shift in treatment paradigms but also underscores the necessity for CDMOs to adapt their capabilities to meet the evolving needs of biopharmaceutical companies.

Growing Investment in Research and Development

The Cell and Gene Therapy CDMO Market is experiencing a surge in investment in research and development (R&D). This trend is driven by the increasing recognition of the potential of cell and gene therapies to address previously untreatable conditions. In 2025, R&D spending in the biopharmaceutical sector is projected to reach unprecedented levels, reflecting a commitment to innovation and therapeutic advancement. CDMOs are integral to this process, as they provide the necessary infrastructure and expertise to support the development of new therapies. The influx of investment not only accelerates the pace of discovery but also enhances the collaboration between CDMOs and biopharmaceutical companies, fostering an environment conducive to innovation. This growing investment landscape is likely to propel the Cell and Gene Therapy CDMO Market forward, creating opportunities for both established and emerging players.

.png)