Regulatory Support and Frameworks

The regulatory landscape surrounding the Advanced Therapy Medicinal Products CDMO Market is evolving, with agencies providing clearer guidelines and support for the development and commercialization of advanced therapies. Regulatory bodies are increasingly recognizing the potential of these therapies, leading to expedited approval processes and incentives for manufacturers. This supportive environment encourages investment in research and development, as companies seek to navigate the complexities of regulatory compliance. The establishment of frameworks that facilitate collaboration between CDMOs and regulatory agencies is likely to enhance the overall efficiency of bringing advanced therapies to market. As a result, the industry is poised for growth, with projections indicating a market expansion to USD 15 billion by 2027.

Rising Patient Awareness and Acceptance

Patient awareness and acceptance of advanced therapies are crucial factors influencing the Advanced Therapy Medicinal Products CDMO Market. As patients become more informed about the benefits of personalized medicine and innovative treatment options, the demand for advanced therapies is likely to increase. Educational initiatives and outreach programs are playing a vital role in enhancing understanding and acceptance among patients and healthcare providers. This growing awareness is expected to drive market growth, as more individuals seek out advanced therapies for conditions that were previously deemed untreatable. The increasing patient advocacy for innovative treatments is likely to create a more favorable landscape for CDMOs, as they align their services with the evolving needs of the healthcare market.

Growing Investment in Biopharmaceuticals

Investment in biopharmaceuticals is a significant driver of the Advanced Therapy Medicinal Products CDMO Market. As pharmaceutical companies increasingly focus on developing biologics and advanced therapies, the demand for specialized manufacturing services is on the rise. Recent reports indicate that biopharmaceutical investments have reached over USD 200 billion, reflecting a robust interest in innovative treatment modalities. This influx of capital is likely to bolster the capabilities of CDMOs, enabling them to expand their service offerings and enhance their technological infrastructure. Consequently, the growth of biopharmaceutical investments is expected to create a favorable environment for CDMOs, facilitating their role in the development and production of advanced therapies.

Advancements in Manufacturing Technologies

Technological advancements play a pivotal role in shaping the Advanced Therapy Medicinal Products CDMO Market. Innovations such as automated bioprocessing, continuous manufacturing, and advanced analytics are revolutionizing the production of advanced therapies. These technologies not only improve efficiency but also enhance product quality and consistency. For instance, the implementation of single-use systems has streamlined operations, reducing contamination risks and lowering costs. As a result, CDMOs are better positioned to meet the increasing demands of the market, which is expected to grow significantly, with estimates suggesting a market size of USD 10 billion by 2025. This technological evolution is essential for maintaining competitiveness in a rapidly evolving landscape.

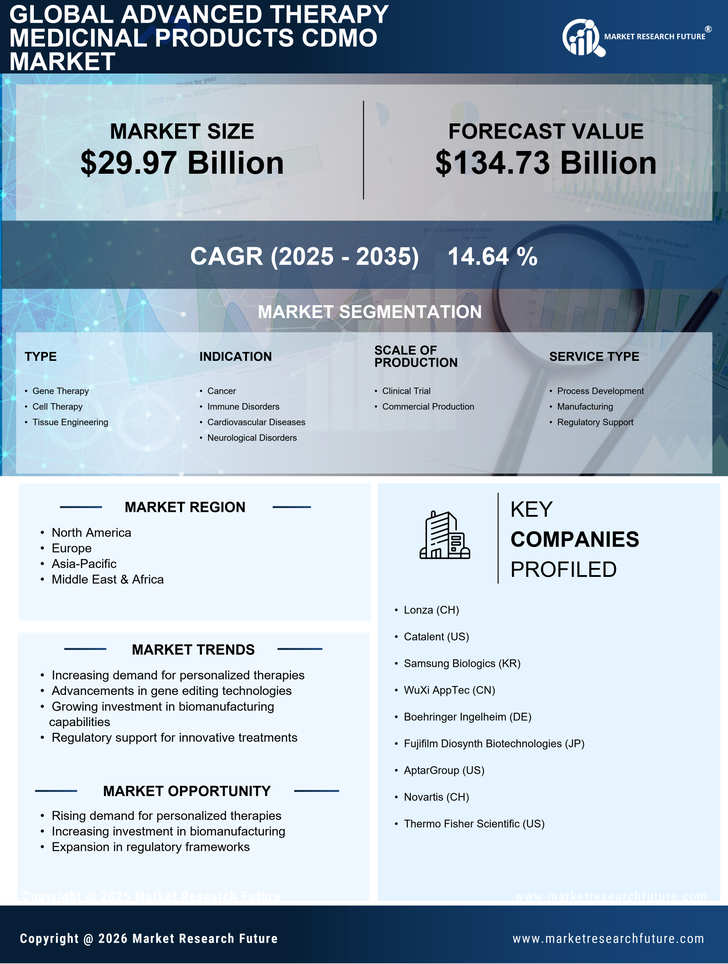

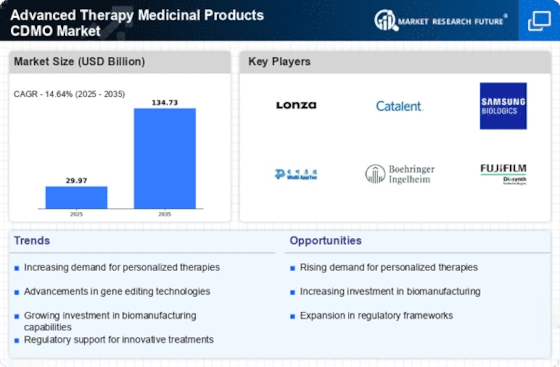

Increasing Demand for Cell and Gene Therapies

The Advanced Therapy Medicinal Products CDMO Market is experiencing a notable surge in demand for cell and gene therapies. This trend is largely driven by the growing prevalence of chronic diseases and genetic disorders, which necessitate innovative treatment solutions. According to recent data, the market for cell and gene therapies is projected to reach approximately USD 20 billion by 2026, indicating a compound annual growth rate of around 30%. This increasing demand compels CDMOs to enhance their capabilities in manufacturing and development, thereby fostering a more robust ecosystem for advanced therapies. As a result, companies are investing in state-of-the-art facilities and technologies to meet the stringent requirements of these complex products.