Increasing Energy Demand

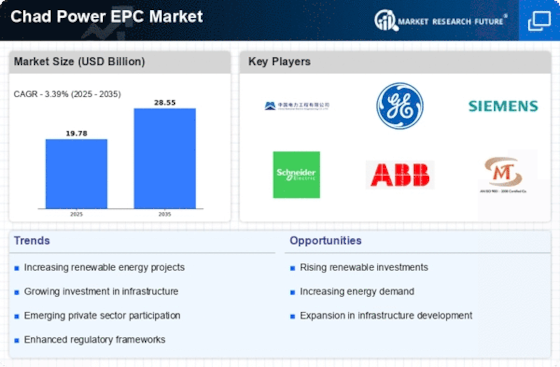

The Chad Power EPC Market is currently experiencing a surge in energy demand, driven by population growth and urbanization. As the population of Chad continues to expand, the need for reliable electricity supply becomes more pressing. The government has recognized this challenge and is actively pursuing initiatives to enhance energy access. Recent data indicates that only about 11% of the population has access to electricity, highlighting a significant gap that the Chad Power EPC Market must address. This growing demand for energy is likely to stimulate investments in power generation projects, thereby creating opportunities for EPC contractors to engage in large-scale infrastructure development.

Government Policy Support

The Chad Power EPC Market benefits from supportive government policies aimed at improving energy infrastructure. The government has outlined strategic plans to increase electricity generation capacity, which includes both renewable and non-renewable sources. Recent policy frameworks have been established to attract private sector participation in the energy sector, thereby enhancing the role of EPC contractors. The government has set ambitious targets for energy access, aiming to achieve universal access by 2030. This policy environment is conducive for the Chad Power EPC Market, as it encourages investment and innovation in energy projects, potentially leading to a more robust energy landscape.

Technological Innovations

Technological advancements are playing a pivotal role in shaping the Chad Power EPC Market. The integration of modern technologies in project management and execution is enhancing efficiency and reducing costs. Innovations such as smart grid technologies and advanced project management software are being adopted to streamline operations. These technologies not only improve project delivery timelines but also enhance the overall quality of power infrastructure. As the Chad Power EPC Market embraces these innovations, it is expected to attract more investments and improve competitiveness, ultimately leading to a more resilient energy sector.

Investment in Renewable Energy

The Chad Power EPC Market is witnessing a notable shift towards renewable energy sources, driven by both environmental concerns and the need for sustainable development. The government has initiated several projects aimed at harnessing solar and wind energy, which are abundant in the region. Recent reports suggest that Chad has the potential to generate over 1,000 MW of solar power, which could significantly contribute to the national grid. This transition towards renewables not only aligns with The Chad Power EPC Industry.

Infrastructure Development Initiatives

Infrastructure development is a critical driver for the Chad Power EPC Market, as the country seeks to modernize its energy framework. The government has launched various initiatives aimed at upgrading existing power plants and constructing new facilities. These initiatives are essential for improving energy reliability and efficiency. Recent investments in infrastructure have been reported to exceed several million dollars, indicating a strong commitment to enhancing the energy sector. As these projects progress, the Chad Power EPC Market is likely to see increased demand for engineering, procurement, and construction services, thereby fostering growth and innovation.