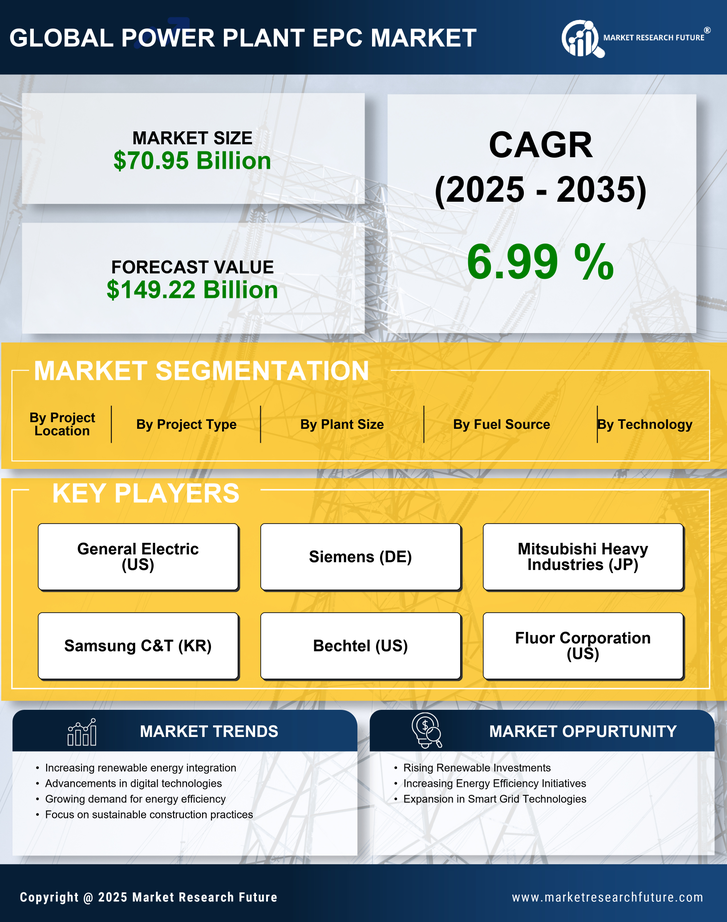

Rising Energy Demand

The Power Plant EPC Market is experiencing a notable surge in energy demand, driven by population growth and industrialization. As economies expand, the need for reliable and efficient energy sources becomes paramount. According to recent data, energy consumption is projected to increase by approximately 25% by 2030.

This escalating demand compels governments and private entities to invest in new power generation facilities, thereby propelling the Power Plant EPC Market forward. The construction of new plants, particularly in developing regions, is likely to create substantial opportunities for EPC contractors. Furthermore, the transition towards cleaner energy sources necessitates the development of advanced power plants, which may further stimulate market growth.

Technological Advancements

Technological advancements are reshaping the Power Plant EPC Market, enabling more efficient and cost-effective power generation solutions. Innovations in energy generation technologies, such as combined cycle gas turbines and advanced solar photovoltaic systems, are becoming increasingly prevalent. These technologies not only enhance the efficiency of power plants but also reduce operational costs, making them more appealing to investors.

Furthermore, the integration of digital technologies, such as IoT and AI, into power plant operations is likely to optimize performance and maintenance. As these technologies continue to evolve, they may drive the demand for new power plants, thereby benefiting the Power Plant EPC Market.

Government Initiatives and Policies

Government initiatives aimed at enhancing energy security and sustainability are significantly influencing the Power Plant EPC Market. Many countries are implementing policies that promote the construction of new power plants, particularly those utilizing renewable energy sources. For instance, various nations have set ambitious targets for reducing carbon emissions, which often include substantial investments in renewable energy infrastructure.

This regulatory environment encourages EPC firms to engage in projects that align with these goals. Additionally, financial incentives and subsidies for renewable energy projects are likely to enhance the attractiveness of investments in the Power Plant EPC Market, fostering a conducive atmosphere for growth.

Investment in Infrastructure Development

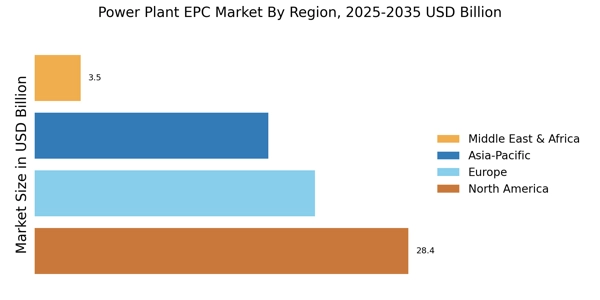

Investment in infrastructure development is a critical driver for the Power Plant EPC Market. Many countries are recognizing the need to modernize their energy infrastructure to meet current and future energy demands. This recognition has led to increased public and private sector investments in power generation facilities.

According to estimates, global investments in energy infrastructure are expected to reach trillions of dollars over the next decade. Such investments are likely to create a robust pipeline of projects for EPC contractors, as new power plants are essential to support economic growth and energy transition efforts. The focus on sustainable infrastructure development further amplifies opportunities within the Power Plant EPC Market.

Growing Interest in Sustainable Energy Solutions

The growing interest in sustainable energy solutions is profoundly impacting the Power Plant EPC Market. As environmental concerns gain prominence, stakeholders are increasingly prioritizing projects that emphasize sustainability. This trend is evident in the rising number of renewable energy projects, such as wind and solar power plants, which are becoming more prevalent in the market. The shift towards sustainable energy not only aligns with global climate goals but also attracts investments from environmentally conscious investors.

Consequently, EPC firms that specialize in sustainable energy projects are likely to find ample opportunities in the Power Plant EPC Market, as demand for eco-friendly power generation continues to rise.