Advancements in Material Science

Advancements in material science significantly influence the Chemical Vapour Deposition Equipment Market. The development of novel materials, such as graphene and other two-dimensional materials, necessitates innovative deposition techniques. CVD equipment is increasingly employed to synthesize these materials, which are pivotal in various applications, including electronics, energy storage, and coatings. The market for advanced materials is expected to grow substantially, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is likely to drive demand for CVD technologies, as researchers and manufacturers seek to explore the unique properties of new materials. Consequently, the Chemical Vapour Deposition Equipment Market is poised to benefit from these advancements, as the need for specialized deposition equipment becomes more pronounced.

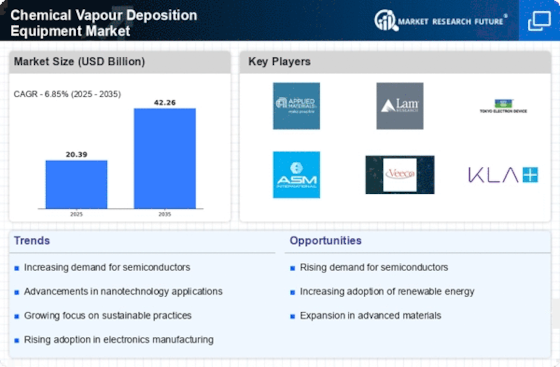

Rising Demand for Semiconductors

The increasing demand for semiconductors is a pivotal driver for the Chemical Vapour Deposition Equipment Market. As industries such as consumer electronics, automotive, and telecommunications expand, the need for advanced semiconductor devices grows. The semiconductor market is projected to reach approximately 600 billion USD by 2025, necessitating sophisticated manufacturing processes. Chemical vapour deposition (CVD) equipment plays a crucial role in producing high-quality thin films essential for semiconductor fabrication. This trend indicates a robust growth trajectory for the CVD equipment sector, as manufacturers seek to enhance production efficiency and yield. Furthermore, the shift towards miniaturization and higher performance in electronic devices amplifies the reliance on CVD technologies, thereby solidifying their importance in the semiconductor supply chain.

Growth in Renewable Energy Technologies

The expansion of renewable energy technologies serves as a significant driver for the Chemical Vapour Deposition Equipment Market. As the world increasingly shifts towards sustainable energy sources, the demand for high-efficiency solar cells and energy storage solutions rises. CVD equipment is essential in the production of thin-film solar cells, which are gaining traction due to their lightweight and flexible characteristics. The solar energy market is projected to grow at a compound annual growth rate of around 20% through 2025, indicating a robust demand for CVD technologies. Additionally, advancements in battery technologies, particularly in lithium-ion batteries, further enhance the need for CVD equipment to create high-performance electrodes. This trend underscores the critical role of CVD in supporting the renewable energy sector.

Regulatory Support for Advanced Manufacturing

Regulatory support for advanced manufacturing processes is emerging as a crucial driver for the Chemical Vapour Deposition Equipment Market. Governments worldwide are increasingly recognizing the importance of advanced manufacturing in fostering economic growth and technological innovation. Initiatives aimed at promoting clean and efficient manufacturing practices are likely to enhance the adoption of CVD technologies. For instance, regulations encouraging the use of environmentally friendly materials and processes may drive manufacturers to invest in CVD equipment that meets these standards. The market for advanced manufacturing is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 8% through 2025. This regulatory landscape creates a conducive environment for the Chemical Vapour Deposition Equipment Market, as companies seek to align with evolving standards and practices.

Increased Investment in Research and Development

Increased investment in research and development (R&D) is a notable driver for the Chemical Vapour Deposition Equipment Market. As industries strive for innovation and competitive advantage, R&D expenditures are on the rise, particularly in sectors such as electronics, aerospace, and healthcare. This investment fosters the development of new applications for CVD technologies, enhancing their versatility and efficiency. Reports indicate that R&D spending in the semiconductor and materials sectors is expected to exceed 100 billion USD by 2025, creating a favorable environment for CVD equipment manufacturers. The emphasis on developing cutting-edge technologies and materials will likely propel the demand for advanced CVD systems, thereby contributing to the overall growth of the market.

Leave a Comment