E-commerce Growth

The rise of e-commerce is transforming the chilled and deli food Market, as more consumers turn to online shopping for their grocery needs. The convenience of home delivery and the ability to easily compare products are driving this trend. Recent data suggests that online grocery sales have surged, with chilled and deli foods representing a significant portion of this growth. Retailers are increasingly investing in their online platforms and logistics to meet consumer demand, ensuring that chilled products are delivered safely and efficiently. This shift not only expands market reach but also enhances consumer engagement, as brands leverage digital marketing strategies to connect with their audience. The continued growth of e-commerce is likely to reshape the distribution channels within the chilled and deli food sector.

Sustainable Practices

Sustainability is becoming a pivotal driver in the Chilled And Deli Food Market, as consumers increasingly prefer products that are environmentally friendly. This shift is prompting companies to adopt sustainable sourcing practices, reduce packaging waste, and implement energy-efficient production methods. Recent statistics indicate that nearly 60% of consumers are willing to pay more for products that are sustainably sourced. Consequently, brands that prioritize sustainability are likely to gain a competitive edge, as they resonate with the values of eco-conscious consumers. This trend not only enhances brand reputation but also aligns with regulatory pressures aimed at reducing environmental impact, thereby shaping the future landscape of the chilled and deli food sector.

Health-Conscious Offerings

The Chilled And Deli Food Market is increasingly influenced by the rising demand for health-conscious food options. Consumers are becoming more aware of the nutritional content of their food, leading to a shift towards products that are lower in preservatives, artificial ingredients, and unhealthy fats. This trend is reflected in the growing popularity of organic and natural chilled foods, which are perceived as healthier alternatives. According to recent data, the market for organic chilled foods has seen a compound annual growth rate of approximately 8% over the past few years. As a result, manufacturers are innovating to create healthier deli meats and ready-to-eat meals that cater to this demographic, thereby expanding their market share and enhancing consumer loyalty.

Convenience and Accessibility

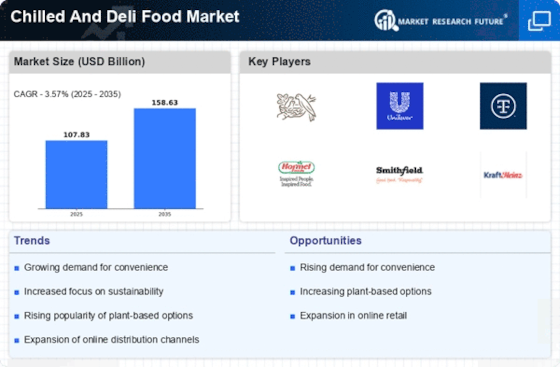

The demand for convenience is a significant driver in the Chilled And Deli Food Market, as busy lifestyles lead consumers to seek quick and easy meal solutions. Ready-to-eat meals, pre-packaged deli items, and easy-to-prepare chilled foods are increasingly popular among consumers who prioritize time-saving options. Market analysis shows that the convenience food segment is projected to grow at a rate of 5% annually, reflecting the changing consumer behavior towards meal preparation. Retailers are responding by expanding their chilled food sections and offering a wider variety of ready-to-eat options, thus enhancing accessibility for consumers. This trend is likely to continue, as the need for convenience remains a top priority for many.

Innovative Product Development

Innovation plays a crucial role in the Chilled And Deli Food Market, as companies strive to differentiate their offerings in a competitive landscape. The introduction of new flavors, unique ingredients, and novel packaging solutions is essential for attracting consumers. Recent trends indicate that plant-based and alternative protein products are gaining traction, with a notable increase in the availability of plant-based deli meats and chilled meals. This innovation not only caters to the growing vegetarian and vegan population but also appeals to flexitarians seeking healthier options. As a result, companies that invest in research and development are likely to capture a larger share of the market, driving growth and consumer interest.