Increased Focus on Data Security

In an era where data breaches are prevalent, the automation as-a-service market in China is witnessing a heightened focus on data security. Organizations are increasingly aware of the risks associated with automation technologies and are seeking solutions that ensure data integrity and compliance. This trend is prompting service providers to enhance their security measures, thereby fostering trust among potential clients. As a result, the market is likely to see a rise in demand for automation solutions that incorporate robust security features. It is estimated that the data security market in China will grow to $30 billion by 2027, which could positively impact the automation as-a-service market as businesses prioritize secure automation.

Shift Towards Smart Manufacturing

The transition to smart manufacturing is a critical driver for the automation as-a-service market in China. As industries embrace Industry 4.0 principles, there is a growing need for integrated automation solutions that enhance production efficiency. Smart factories leverage IoT and data analytics to optimize operations, and automation as-a-service plays a pivotal role in this transformation. Recent statistics indicate that the smart manufacturing sector in China is projected to reach $300 billion by 2025, with automation solutions being a key component. This shift not only improves operational capabilities but also positions companies to respond swiftly to market demands, thereby driving the automation as-a-service market.

Government Initiatives and Support

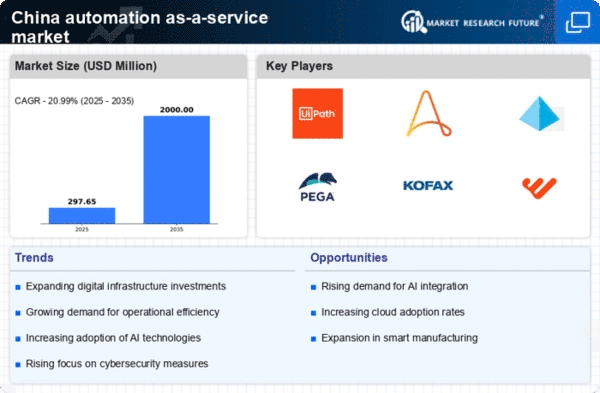

The Chinese government is actively promoting the adoption of automation technologies across various sectors. Initiatives aimed at enhancing digital transformation are encouraging businesses to invest in automation as-a-service solutions. Policies that support innovation and technology development are likely to create a favorable environment for market growth. For instance, the government has allocated substantial funding to support research and development in automation technologies. This support is expected to drive the automation as-a-service market, with estimates suggesting a compound annual growth rate (CAGR) of 20% over the next five years. Such initiatives may lead to increased collaboration between public and private sectors, further bolstering market expansion.

Rising Demand for Operational Efficiency

The automation as-a-service market in China is experiencing a notable surge in demand for operational efficiency. Businesses are increasingly recognizing the need to streamline processes and reduce manual intervention. This trend is driven by the desire to enhance productivity and minimize errors. According to recent data, companies that have adopted automation solutions report a productivity increase of up to 30%. As organizations strive to remain competitive, the the automation as-a-service market is expected to grow significantly. Projections indicate a potential market size of $10 billion by 2026.. This growth is likely fueled by the need for faster decision-making and improved service delivery.

Growing Need for Scalability and Flexibility

The dynamic business environment in China necessitates a growing need for scalability and flexibility in operations. Companies are increasingly adopting automation as-a-service solutions to adapt to changing market conditions and customer demands. This flexibility allows organizations to scale their operations efficiently without incurring significant upfront costs. the market is likely to benefit from this trend. Businesses seek solutions tailored to their specific needs.. Recent analyses suggest that the market for scalable automation solutions could reach $15 billion by 2028, indicating a robust growth trajectory driven by the demand for adaptable business models.