Data-Driven Decision Making

In the Blasting Automation Service Market, the trend towards data-driven decision making is reshaping operational strategies. The ability to collect and analyze data from blasting operations allows companies to make informed decisions that enhance performance and safety. Advanced analytics tools are being utilized to optimize blast designs and predict outcomes, which can lead to cost savings and improved results. Recent studies indicate that organizations leveraging data analytics in their blasting operations have seen a 25% reduction in costs associated with misfires and inefficiencies. This trend is likely to continue, further driving the demand for automation services.

Cost Efficiency and Labor Shortages

Cost efficiency is a critical driver in the Blasting Automation Service Market, particularly in light of ongoing labor shortages across various sectors. Automated blasting solutions can significantly reduce labor costs while maintaining high levels of safety and precision. By minimizing the need for manual intervention, companies can allocate resources more effectively and enhance overall productivity. Recent analyses suggest that automation can lead to a 30% reduction in labor costs associated with blasting operations. As businesses seek to optimize their expenditures, the adoption of blasting automation services is expected to rise, thereby fueling market expansion.

Sustainability and Environmental Regulations

The Blasting Automation Service Market is significantly influenced by the growing emphasis on sustainability and stringent environmental regulations. Companies are increasingly required to minimize their environmental footprint, leading to a shift towards automated blasting solutions that reduce emissions and waste. The implementation of automated systems can lead to a reduction in explosive usage by up to 15%, aligning with regulatory standards. Furthermore, as industries face pressure to adopt greener practices, the demand for blasting automation services that comply with environmental guidelines is expected to rise, thereby propelling market growth.

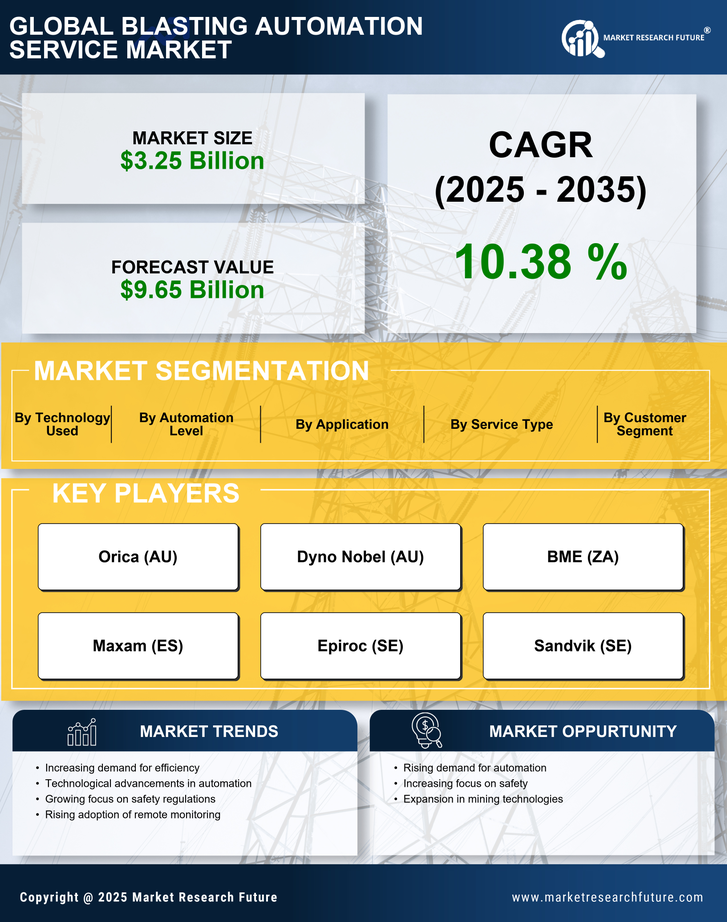

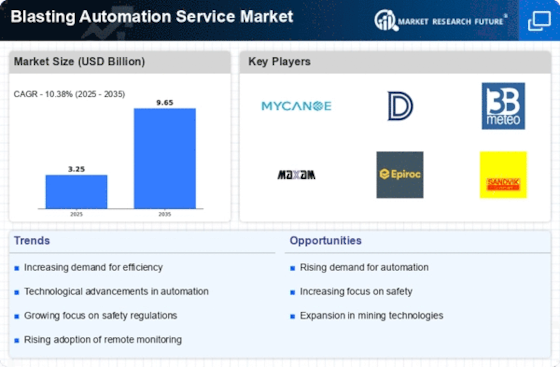

Technological Advancements in Blasting Automation

The Blasting Automation Service Market is experiencing a surge in technological advancements that enhance operational efficiency and safety. Innovations such as real-time monitoring systems and automated blast design software are becoming increasingly prevalent. These technologies allow for precise control over blasting operations, reducing the risk of accidents and improving overall productivity. According to recent data, the integration of automation technologies has led to a 20% increase in operational efficiency in various sectors, including mining and construction. As companies seek to optimize their processes, the demand for advanced blasting automation solutions is likely to grow, driving the market forward.

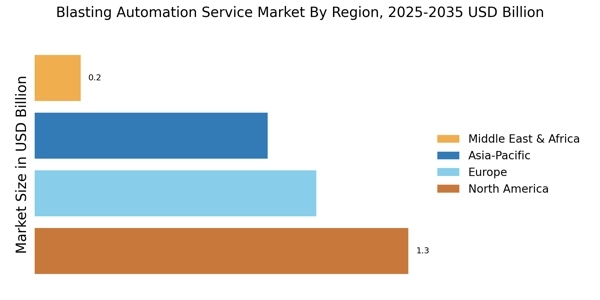

Increased Demand from Mining and Construction Sectors

The Blasting Automation Service Market is witnessing increased demand from the mining and construction sectors, which are heavily reliant on efficient blasting operations. As these industries expand, the need for automated blasting solutions that enhance safety and productivity becomes more pronounced. The mining sector, in particular, is projected to grow at a CAGR of 5% over the next five years, creating a substantial market for blasting automation services. Companies are investing in automation to streamline their operations and reduce labor costs, which is likely to further stimulate market growth in the coming years.