Growing Middle-Class Population

The expanding middle-class population in China is a pivotal driver for the fragrance market. As disposable incomes rise, consumers are increasingly willing to invest in personal care products, including fragrances. This demographic shift indicates a potential market growth, with the fragrance market projected to reach approximately $10 billion by 2026. The growing middle class is not only seeking luxury items but also exploring diverse fragrance options, leading to a surge in demand for both international and local brands. This trend suggests that the fragrance market will continue to flourish as more consumers prioritize personal grooming and self-expression through scent.

Expansion of E-commerce Platforms

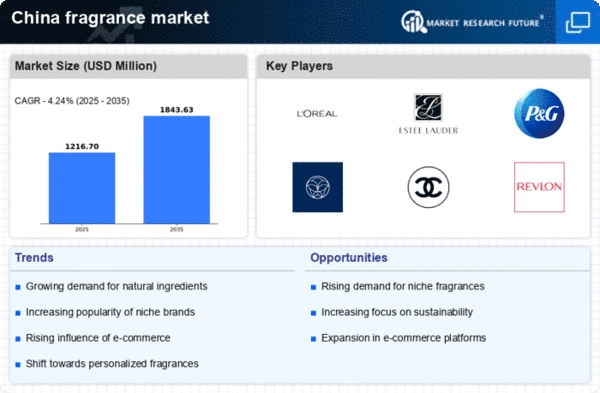

The rapid expansion of e-commerce platforms in China is transforming the fragrance market landscape. Online shopping offers consumers convenience and access to a wider variety of products, including niche and luxury fragrances that may not be available in physical stores. As of 2025, e-commerce is projected to account for over 50% of fragrance market sales in China. This shift towards online retailing allows brands to reach a broader audience and engage with consumers through targeted marketing strategies. The growth of e-commerce is likely to enhance competition among brands, driving innovation and variety in the fragrance market.

Cultural Significance of Fragrance

In China, fragrance holds deep cultural significance, often associated with personal identity and social status. The fragrance market benefits from this cultural appreciation, as consumers are inclined to purchase scents that reflect their personality and values. Traditional Chinese fragrances, such as those derived from natural ingredients, are gaining popularity, indicating a shift towards authenticity and heritage in scent selection. This cultural inclination suggests that the fragrance market will continue to thrive, with brands that respect and incorporate local traditions likely to capture a larger share of the market.

Rising Demand for Gender-Neutral Fragrances

The increasing acceptance of gender fluidity in society is influencing consumer preferences in the fragrance market. There is a notable rise in demand for gender-neutral fragrances, appealing to a broader audience beyond traditional gender norms. This trend reflects a shift in consumer attitudes, with many seeking scents that resonate with their personal identity rather than conforming to conventional gender categories. As of 2025, it is estimated that gender-neutral fragrances could represent up to 20% of the fragrance market in China. This evolving landscape suggests that brands focusing on inclusivity and diversity in their fragrance offerings may find significant opportunities for growth.

Influence of Social Media and Celebrity Endorsements

Social media platforms play a crucial role in shaping consumer preferences within the fragrance market. Influencers and celebrities often promote specific fragrances, creating trends that resonate with younger audiences. This phenomenon has led to a notable increase in fragrance sales, particularly among millennials and Gen Z consumers. In 2025, it is estimated that social media-driven marketing strategies could account for up to 30% of total fragrance market sales in China. The ability to reach a vast audience through digital channels allows brands to engage consumers effectively, thereby enhancing brand loyalty and driving market growth.